FE837

Sample Avocado Production Costs and Protability

Analysis for Florida

1

Edward A. Evans and Ingrid Bernal Lozano

2

1. This is EDIS document FE837, a publication of the Food and Resource Economics Department, UF/IFAS Extension. Published June 2010; revised

December 2014. Please visit the EDIS website at http://edis.ifas.u.edu.

2. Edward A. Evans, assistant professor, and Ingrid Bernal Lozano, research assistant, Food and Resource Economics Department, University of Florida,

Tropical Research and Education Center, Homestead, FL; UF/IFAS Extension, Gainesville, FL 32611

The Institute of Food and Agricultural Sciences (IFAS) is an Equal Opportunity Institution authorized to provide research, educational information and other services

only to individuals and institutions that function with non-discrimination with respect to race, creed, color, religion, age, disability, sex, sexual orientation, marital status,

national origin, political opinions or aliations. For more information on obtaining other UF/IFAS Extension publications, contact your county’s UF/IFAS Extension oce.

U.S. Department of Agriculture, UF/IFAS Extension Service, University of Florida, IFAS, Florida A & M University Cooperative Extension Program, and Boards of County

Commissioners Cooperating. Nick T. Place, dean for UF/IFAS Extension.

Introduction

As an important tree fruit crop to the agricultural economy

of Florida, the avocado industry is second only to citrus

(NASS/USDA 2008). Annual farm gate sales are worth

about $24.4 million. At the wholesale end of the market, the

Florida avocado industry is worth upwards of $35 million

per year (P. Brooks, personal communication, 2014).

Approximately 80 percent of the crop is sold outside of the

state; hence, the industry brings in a substantial amount of

“new dollars” to the state, resulting in an overall economic

impact of close to $100 million per annum (A. Hodges,

personal communication, 2014). e industry consists of

about 7,000 acres (NASS/USDA 2013), representing about

60 percent of the total tropical fruit crop acreage. ere

are about 500 registered growers and about 30 registered

avocado handlers and shippers (A. Flinn, personal com-

munication, 2014). Over 98 percent of the avocados are

grown in Miami-Dade County. Orchard size ranges from

0.1 to over 500 acres, with 93 percent of the farms less than

15 acres (NASS/USDA 2009).

Although avocado varieties produced in South Florida look

similar due to their “green skin” and are easily distinguish-

able from the “purplish-black skin” varieties grown in

California, they dier somewhat and fall into one of three

main types: West Indian, Guatemalan, and Mexican. ese

three avocado types collectively comprise some 60 major

and minor commercial varieties that mature at dierent

times during the season in various weights and sizes. As

a consequence, yields per acre vary among producers,

depending on the production techniques and varieties

grown. ere is also a tendency of alternate-year bearing,

implying high yields one year and lower yields the next

(although, recently, the pattern is less obvious). In recent

years, there has been an upward trend with respect to

average yields. is is due in part to trees being replanted

with higher-yielding varieties and closer planting density.

is practice started aer the devastation to the industry

caused by Hurricane Andrew in 1992 and has intensied

within recent years.

is article provides an estimate of the costs and returns as-

sociated with avocado production in Miami-Dade County

and a brief analysis of the protability of the industry. Our

sample budget is based on a ve-year average marketable

yield of 16,500 pounds, or 300 bushels (1 bushel = 55

pounds), per acre, and on estimates of the eld run price.

is price represents the average price the growers receive

from the packing house for the total quantity marketed

(delivered to the packing house), assuming a pack-out

rate of about 80 percent. e budget does not make any

provision for establishment costs. If the grove were recently

established, an additional charge (amortization) should be

included in the xed costs (FE956) Although the assump-

tions made in computing the costs reect the practices of

the avocado growers in the area, the information provided

here is intended only as a guide to facilitate estimating the

2

Sample Avocado Production Costs and Protability Analysis for Florida

nancial requirements of maintaining avocado groves. Data

used in the analysis were obtained from interviews with

growers and Extension specialists.

Cost of Production

Table 1 illustrates a sample budget, indicating a total

pre-harvest cost of $2,741 per acre, or $0.17 per pound of

avocados produced (on the tree). Of the total pre-harvest

cost, operating costs totaled $1,596 and xed costs were

estimated at $1,145 per acre. e main operating costs were

fungicide, fertilizer, and mow, with shares of 25.5 percent,

22.1 percent, and 15.9 percent, respectively. is is not

surprising, given that fungicide is now the main cost item

due to the threat of Laurel Wilt Disease, a deadly fungus

that was discovered in the commercial avocado production

area in 2012. Several growers have been applying fungicide

as a spot treatment or in a prophylactic manner (P. Brooks,

personal communications, 2014). Included under xed

costs were land rent, insurance, taxes, and overhead

expenses (investment repairs and cost recovery for owned

machinery). Although the majority of farmers own the

land, an opportunity cost for the land was included equal to

the existing land rental rate ($500 per acre). is reects the

standard practice of valuing the contribution of the land.

When harvesting and marketing costs are added to

production costs, the total per-acre cost increases to

$3,797. is translates into a cost of $0.23 per pound to

produce, harvest, and market avocados ($0.064 per pound

is added to the $0.17 per pound cost of production to cover

harvesting and marketing costs). e only contributor to

the harvesting and marketing costs is the cost associated

with picking and hauling. Because the fruit is easily

bruised and scratched, avocados are hand-picked with the

aid of self-propelled, hydraulically-powered equipment

for positioning the worker in areas of the tree not easily

reached from the ground. is makes harvesting a highly

labor-intensive operation and relatively expensive. Federal

Marketing Order 915, in existence since 1954, regulates

production practices and harvesting procedures, such as

those governing the size and quality of the fruit, as well as

packing and shipping containers, and shipping dates. e

Order is aimed at increasing grower returns by promoting

orderly marketing conditions while at the same time ensur-

ing consumer satisfaction. Harvested avocados are placed

in bins and transported to packing houses.

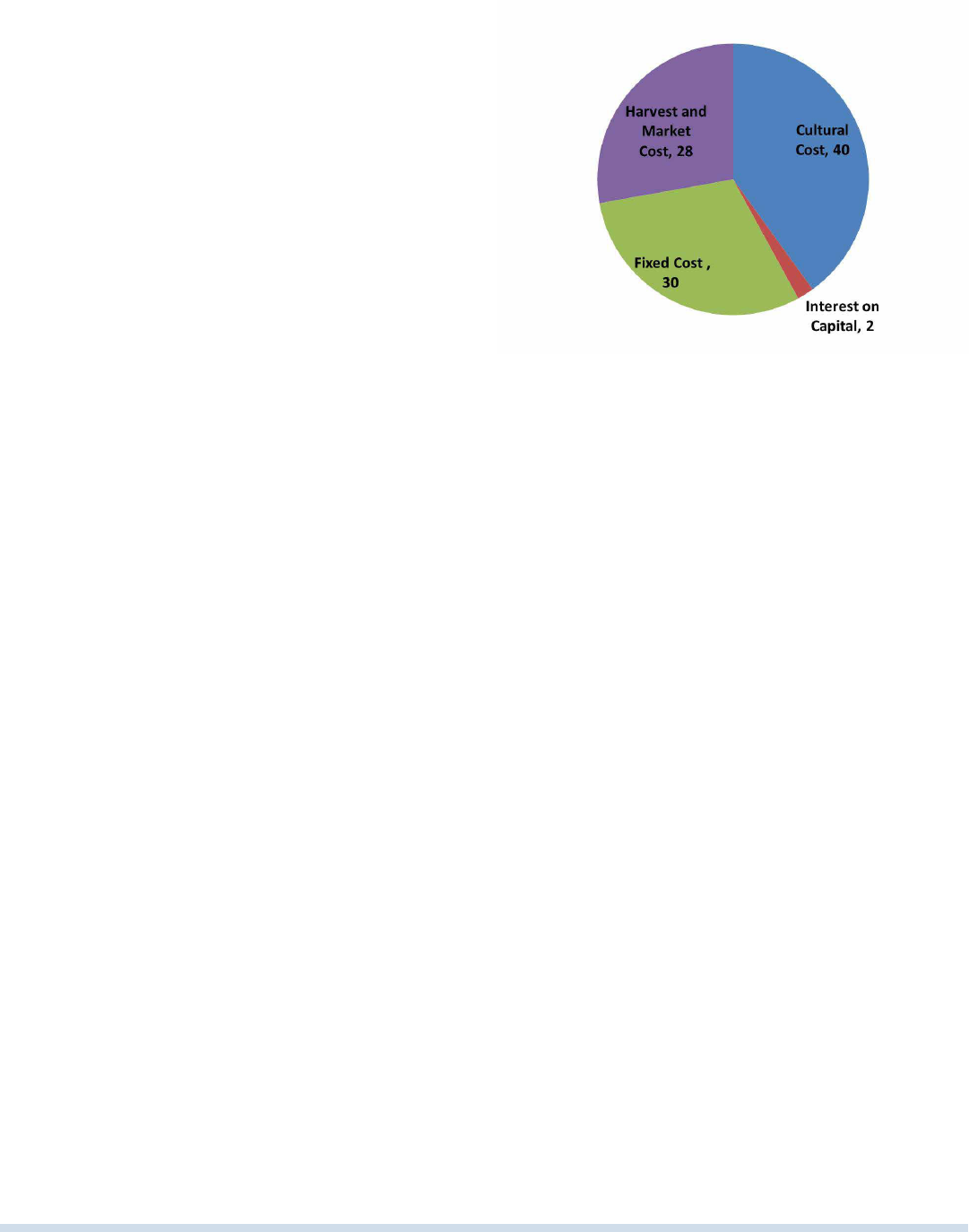

Figure 1 illustrates the proportion of costs by category.

Harvest and marketing costs account for approximately

28 percent of the total cost of producing and marketing

the crop. e cultural cost (e.g., pruning, fertilization, and

pest control) is about 40 percent; xed or overhead cost

accounts for 30 percent; and, interest on capital is 2 percent.

Returns and Protability Analysis

Avocado yield varies from less than 11,000 pounds per acre

in a poorly managed orchard to more than 20,000 pounds

per acre in a well-managed orchard, Yield also varies by

variety. For this study, we used an average yield of about

16,500 pounds (300 bushels) per acre for a reasonably

well-managed orchard. Assuming a planting density of 100

trees per acre, this implies a yield of about 165 pounds (3

bushels) per tree. As mentioned earlier, we assumed a Field

Run Price (grower’s price) of $0.31 per pound, resulting in

gross revenue of $5,122 per acre. Subtracting the total cost

of production and marketing ($3,797) from the revenue

($5,122) gives a net return to the grower of about $1,325

per acre, or around $0.08 per pound of marketable fruit

(Table 1). is represents a return of 34.9 percent on the

total cost of producing and marketing avocados. Given that

most Florida avocado growers (93%) produce on farms less

than 15 acres and 72 percent of growers produce avocados

on farms less than 5 acres, total net return for the majority

of growers is less than $19,870 per annum. It should be

pointed out that many of the growers who own their land

tend to ignore the xed costs and instead focus on the gross

margin as their prot (i.e., the dierence between total

revenue and operating and marketing costs). Following

such an approach implies a return of about $0.15 per pound

($0.31 – $0.10 – $0.06 = $0.15), or $2,470 per acre. While

such a return appears more favorable, it still may be insuf-

cient for a 10-acre family farm. It can be assumed that

some growers remain in the industry for land speculation

and have other sources of income.

Figure 1. Proportion of costs

3

Sample Avocado Production Costs and Protability Analysis for Florida

Sensitivity Analysis

Table 2 presents a sensitivity analysis of net returns to a

grower on a per-acre basis, while Table 3 presents a similar

analysis conducted on the basis of gross margin (gross

prot). In the best-case scenario where both price and yield

are assumed to increase by 10 percent, net return per acre

would increase from $1,325 to $2,068. In the worst-case

scenario where both price and yield decline by 10 percent,

net return per acre would decrease from $1,325 to $467 per

acre. Other combinations of changes of prices and yields

and their impact on net return per acre are shown in Table

2 as well. However, it should be noted that at the industry

level, a sizeable increase in production usually results in a

decreased in the price received by the growers. In general,

it can be assumed than a 10-percent increase in output by

the industry (aggregate) is likely to result in a 4.3 percent

price reduction, other factors remaining constant. In

addition, promotion of the health benets associated with

the consumption of avocados is increasing the demand for

avocados and could serve to lessen the price impact result-

ing from increased supply of avocados. e information

presented in Table 3 can be interpreted in a similar manner

to that presented in Table 2, noting that this is with respect

to gross prot which ignores the xed cost estimates.

Concluding Remarks

Our estimate of total annual production cost (including

harvesting) for avocados in South Florida is $3,797 per acre,

or about $12.66 per bushel. With a gross revenue of $5,122

per acre ($17.07 per bushel), this implies a net return to

the grower of about $1.325 per acre, or $4.42 per bushel.

Since most growers sell their crop to packing houses, they

are somewhat restricted in their ability to inuence the

price they receive; however, they can adopt practices that

will increase their pack-out rates and, consequently, the

protability of their operations. e recent threat from the

discovery of the Red Ambrosia Beetle and Laurel Wilt Dis-

ease within the major avocado production areas is already

having a negative impact on the cost of production. e

continued spread of this dealy disease is of grave concern

since any major addition to production costs associated

with the management of this pest and disease could easily

cause many of these operations to become unprotable.

References

De Oleo, B., E.A. Evans, and J.H. Crane. 2014. Establish-

ment cost of avocados in South Florida. EDIS #FE956. UF/

IFAS Extension, Gainesville, FL.

NASS/USDA. 2008. Noncitrus Fruits and Nuts: 2008

Preliminary Summary, FrNt1-3(09)a. National Agricultural

Statistic Service, United States Department of Agriculture,

Washington, D.C. http://usda.mannlib.cornell.edu/usda/

nass/NoncFruiNu//2000s/2009/NoncFruiNu-01-23-2009_

revision.pdf

NASS/USDA. 2009. 2007 Census of Agriculture, Florida―

State and County Data, Volume 1: Graphic Area Series, Part

9. National Agricultural Statistic Service, United States

Department of Agriculture, Washington, D.C. http://

www.agcensus.usda.gov/Publications/2007/Full_Report/

Volume_1,_Chapter_1_State_Level/Florida/v1.pdf

NASS/USDA. 2013. Noncitrus Fruits and Nuts: 2013

Summary, 1948–2698. July 2014. National Agricultural

Statistic Service, United States Department of Agriculture,

Washington, D.C. http://usda.mannlib.cornell.edu/usda/

current/NoncFruiNu/NoncFruiNu-07-17-2014_revision.

pdf

4

Sample Avocado Production Costs and Protability Analysis for Florida

Table 1. Sample budget for avocado production

Item Quantity Value per Acre Value per Pound

(pound) ($/acre/year) ($/pound)

REVENUE

Marketable yield (pounds/acre) 16,500

Field run price 0.31

Total revenue 5,122

OPERATING COSTS

Fertilizer 352

Fungicide 407

Herbicide 136

Insecticide 125

Pruning 150

Irrigation 96

Mow, vine, miscellaneous 254

Interest on operating capital 5% 76

Total operating cost 1,596 0.10

FIXED COSTS

Cash overhead

Insurance 100

Taxes 100

Non-cash overhead

Land rent 500

Other overhead 445

Total xed cost 1,145 0.07

TOTAL PRE-HARVEST COST 2,741 0.17

HARVEST & MARKETING COSTS

Pick and Haul — $0.064/pound 1,056 0.06

Total harvest and market cost 1,056 0.06

TOTAL COST 3,797 0.23

GROSS MARGIN 2,470 0.15

ESTIMATED NET RETURNS 1,325 0.08

5

Sample Avocado Production Costs and Protability Analysis for Florida

Table 2. Sensitivity analysis, net returns per acre

Yield Wholesale Price

(pounds/acre) (dollars/pound)

0.28 0.29 0.31 0.33 0.34

(–10%) (–5%) (base) (+5%) (+10%)

14,850 (–10%) 467 615 918 1,209 1,358

15,675 (–5%) 645 802 1,115 1,429 1,585

16,500 (base) 823 988 1,325 1,648 1,813

17,325 (+5%) 1,001 1,174 1,521 1,867 2,041

18,150 (+10%) 1,179 1,361 1,724 2,087 2,068

6

Sample Avocado Production Costs and Protability Analysis for Florida

Table 3. Sensitivity analysis, gross margin per acre

Yield Wholesale Price

(pounds/acre) (dollars/pound)

0.28 0.29 0.31 0.33 0.34

(–10%) (–5%) (base) (+5%) (+10%)

14,850 (–10%) 1,512 1,760 2,057 2,354 2,503

15,675 (–5%) 1,790 1,947 2,260 2,574 2m730

16,500 (base) 1,968 2,133 2,470 2,793 2,958

17,325 (+5%) 2,146 2,319 2,666 3,012 3,186

18,150 (+10%) 2,324 2,506 2,869 3,232 3,413