State of New Mexico

Component Appropriation Funds

Annual Financial Report

June 30, 2023

State of New Mexico

Component Appropriation Funds

Table of Contents

Page

Official Roster 1

Independent Auditor’s Report 2-4

Management’s Discussion and Analysis (Unaudited) 5-12

Financial Statements

Balance Sheets 14-15

Statutorily Created Funds

Common School Current Fund

Current School Fund

State Support Reserve Fund

Excess Extraction Tax Fund

Administratively Created Funds

Appropriation Account Fund

Federal Mineral Leasing Fund

Appropriation Contingency

Reserve Fund

General Operating Reserve Fun

d

Statements of Revenues, Expenditures and Changes in Fund Balances 16-17

Statutorily Created Funds

Common School Current Fund

Current School Fund

State Support Reserve Fund

Excess Extraction Tax Fund

Administratively Created Funds

Appropriation Account Fund

Federal Mineral Leasing Fund

Appropriation Contingency

Reserve Fund

General Operating Reserve Fun

d

Notes to the Financial Statements 19-29

Other Information (Unaudited)

Schedule of Statutorily and Administratively Created Funds (including

the Unaudited Tobacco Settlement Permanent Fund & Tax

Stabilization Fund) Balance Sheets 31-32

Schedule of Statutorily and Administratively Created Funds (including

the Unaudited Tobacco Settlement Permanent Fund & Tax Stabilization

Fund) Revenues, Expenditures and Changes in Fund Balances 33-34

Schedule of Revenues by Source 35-36

State of New Mexico

Component Appropriation Funds

Table of Contents — continued

Page

Other Information (Unaudited) — continued

Schedule of Appropriations 37-44

Schedule of Amounts from Other State Entities 45

Schedule of Amounts Due from Taxpayers 46

Schedule of Amounts Due to Local Governments 47

Schedule of Amounts Due to Taxpayers 48

Schedule of Transfers In/(Out) 49-54

Schedule of Appropriations by Function of Government 55

Schedule of Due from Beneficiaries 56

Schedule of Amounts Due to Other State Entities 57

Compliance

Independent Auditor’s Report on Internal Control Over Financial

Reporting and on Compliance and Other Matters Based on an

Audit of Financial Statements Performed in Accordance

With Government Auditing Standards 58-59

Schedule of Findings and Responses 60

Schedule of Prior Year Audit Findings 61

Exit Conference 62

1

State of New Mexico

Component Appropriation Funds

Official Roster

June 30, 2023

Elected Official

Governor Michelle Lujan-Grisham

Officials

Department of Finance and Administration:

Cabinet Secretary Wayne Propst

State Controller Mark Melhoff (Acting)

Deputy Division Director Kusum Adhikari (Acting)

CLA(CliftonLarsonAllenLLP)isanindependentnetworkmemberofCLAGlobal.SeeCLAglobal.com/disclaimer.

CliftonLarsonAllenLLP

CLAconnect.com

2

INDEP

ENDENT AUDITORS’ REPORT

Mr. Wayne Propst, Cabinet Secretary

State of New Mexico Department of Finance and Administration

and Mr. Joseph M. Maestas, P.E., New Mexico State Auditor

Santa Fe, New Mexico

Report on the Audit of the Financial Statements

Opinions

We have audited the accompanying financial statements of each of the statutorily and administratively

created funds that comprise the Component Appropriation Funds of the State of New Mexico (the

Component Appropriation Funds) as defined in the table of contents, as of and for the year ended

June 30, 2023, and the related notes to the financial statements, as listed in the table of contents.

In our opinion, the financial statements referred to above present fairly, in all material respects, the

respective financial position of the Component Appropriation Funds, as defined in the table of contents,

as of June 30, 2023, and the respective changes in financial position for the year then ended in

accordance with accounting principles generally accepted in the United States of America.

Basis for Opinions

We conducted our audit in accordance with auditing standards generally accepted in the United States

of America (GAAS) and the standards applicable to financial audits contained in Government Auditing

Standards, issued by the Comptroller General of the United States. Our responsibilities under those

standards are further described in the Auditors’ Responsibilities for the Audit of the Financial

Statements section of our report. We are required to be independent of the Component Appropriation

Funds and to meet our other ethical responsibilities, in accordance with the relevant ethical

requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and

appropriate to provide a basis for our audit opinions.

Emphasis of Matter

As discussed in Note 1A, the financial statements present only the Component Appropriation Funds

and do not purport to, and do not, present fairly the financial position of the State of New Mexico as of

June 30, 2023, and the changes in its financial position, or where applicable, its cash flows for the year

then ended in accordance with accounting principles generally accepted in the United States of

America. Our opinions are not modified with respect to this matter.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with accounting principles generally accepted in the United States of America, and for the

design, implementation, and maintenance of internal control relevant to the preparation and fair

presentation of financial statements that are free from material misstatement, whether due to fraud or

error.

Mr. Wayne Propst, Cabinet Secretary

State of New Mexico Department of Finance and Administration

and Mr. Joseph M. Maestas, P.E., New Mexico State Auditor

3

Auditors’ Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole

are free from material misstatement, whether due to fraud or error, and to issue an auditors’ report that

includes our opinions. Reasonable assurance is a high level of assurance but is not absolute assurance

and therefore is not a guarantee that an audit conducted in accordance with GAAS and Government

Auditing Standards will always detect a material misstatement when it exists. The risk of not detecting a

material misstatement resulting from fraud is higher than for one resulting from error, as fraud may

involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Misstatements are considered material if there is a substantial likelihood that, individually or in the

aggregate, they would influence the judgment made by a reasonable user based on the financial

statements.

In performing an audit in accordance with GAAS and Government Auditing Standards, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial stat

ements, whether due

to fraud or

error, and design and perform audit procedures responsive to those risks. Such

procedures include examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements.

Obtain an understanding of internal control relevant to the audit in

order to design audit

procedures

that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Component Appropriation Funds’ internal control.

Accordingly, no such opinion is expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

financial stat

ements.

We are required to communicate with those cha

rged with governance regarding, among other matters,

the planned scope and timing of the audit, significant audit findings, and certain internal control related

matters that we identified during the audit.

Required Supplementary Information

Accounting principles generally accepted in the United States of America require that the

management’s discussion and analysis be presented to supplement the financial statements. Such

information is the responsibility of management and, although not a part of the financial statements, is

required by the Governmental Accounting Standards Board who considers it to be an essential part of

financial reporting for placing the financial statements in an appropriate operational, economic, or

historical context. We have applied certain limited procedures to the required supplementary

information in accordance with GAAS, which consisted of inquiries of management about the methods

of preparing the information and comparing the information for consistency with management’s

responses to our inquiries, the financial statements, and other knowledge we obtained during our audit

of the financial statements. We do not express an opinion or provide any assurance on the information

because the limited procedures do not provide us with sufficient evidence to express an opinion or

provide any assurance.

Mr. Wayne Propst, Cabinet Secretary

State of New Mexico Department of Finance and Administration

and Mr. Joseph M. Maestas, P.E., New Mexico State Auditor

4

Other Information

Management is responsible for the other information included in the annual report. The other

information comprises the Schedule of Statutorily and Administratively Created Funds Balance Sheets

and Revenues, Expenditures and Changes in Fund Balances, Schedule of Revenues by Source,

Schedule of Appropriations, Schedule of Amounts from Other State Entities, Schedule of Amounts Due

from Taxpayers, Schedule of Amounts Due to Local Governments, Schedule of Amounts Due to

Taxpayers, Schedule of Transfers In/(Out), Schedule of Appropriations by Function of Government,

Schedule of Due from Beneficiaries, Schedule of Amounts Due to Other State Entities, the Official

Roster, and Exit Conference, but does not include the financial statements and our auditors’ report

thereon. Our opinions on the financial statements do not cover the other information, and we do not

express an opinion or any form of assurance thereon.

In connection with our audit of the financial statements, our responsibility is to read the other

information and consider whether a material inconsistency exists between the other information and the

financial statements, or the other information otherwise appears to be materially misstated. If, based on

the work performed, we conclude that an uncorrected material misstatement of the other information

exists, we are required to describe it in our report.

Other Reporting Required by Government Auditing Standards

In accordance with Government Auditing Standards, we have also issued our report dated

November 22, 2023, on our consideration of the Component Appropriation Funds’ internal control over

financial reporting and on our tests of its compliance with certain provisions of laws, regulations,

contracts, and grant agreements and other matters. The purpose of that report is solely to describe the

scope of our testing of internal control over financial reporting and compliance and the results of that

testing, and not to provide an opinion on the effectiveness of the Component Appropriation Funds’

internal control over financial reporting or on compliance. That report is an integral part of an audit

performed in accordance with Government Auditing Standards in considering the Component

Appropriation Funds’ internal control over financial reporting and compliance.

CliftonLarsonAllen LLP

Albuquerque, New Mexico

November 22, 2023

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

5

Overview of the Reporting Entity

The Component Appropriation Funds of the State of New Mexico (the “Funds”) consist of eights funds, four

created by statute and four administratively created:

Statutorily Created Funds

Common School Current Fund

Current School Fund

State Support Reserve Fund

Excess Extraction Suspense Fund

Administratively Created Funds

Appropriation Account Fund

Federal Mineral Leasing Fund

Appropriation Contingency Reserve Fund

General Operating Reserve Fund

The Funds are part of the General Fund of the State of New Mexico, as reported in the State’s Comprehensive

Annual Financial Report.

This report has been prepared to meet the information needs of interested parties—the public, bond holders,

bond rating agencies, the New Mexico State Legislature—and to comply with the State of New Mexico Audit

Act. It presents the financial position and results of the operations of each of the Funds. The Tobacco

Settlement Permanent Fund and the Tax Stabilization Fund, which are reserve funds of the state and are

managed and reported by the State Investment Council, which is responsible for investment activities related

to this and other similar funds. The Schedules presented in other information include the unaudited Tobacco

Settlement Permanent Fund and Tax Stabilization Fund as “memorandum only” totals.

Financial Highlights

The Funds ended the year with aggregate reserves of 47.3% of recurring current year appropriations which

was a 9.3% increase from 2022.

The Tobacco Settlement Permanent Fund and Tax Stabilization Fund are managed and reported by the New

Mexico State Investment Council (SIC) under statute and reflective of stewardship assignment and investment

reporting requirements related to the corpus.

In fiscal year 2023, excluding the Tobacco Settlement Permanent Fund and Tax Stabilization Fund, the

aggregate fund balance of the Funds decreased by $19.5 million.

Fiscal year 2023 compares to fiscal year 2022 as follows (excluding those funds managed by SIC):

General and selective taxes, which include GRT, are the largest revenue source, contributing $4.8 billion or

37.9% of total revenues in fiscal year 2023. Those revenues increased by $662.2 million or 16%.

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

6

Rents and Royalties are the second largest revenue source contributing $3.3 billion or 25.8% of total

revenues in fiscal year 2023. Those revenues increased by $942.3 million or 40.5%. This increase was

related to the oil & gas industry.

Income taxes are the third largest revenue source contributing $2.1 billion or 17.2% of total revenues in

fiscal year 2023. Those revenues increased by $405 million or 22.9% in 2023.

Severance taxes are the fourth largest revenue source contributing $2.1 billion or 16.9% of total revenues in

fiscal year 2023. Those revenues increased by $157.7 million or 7.9% in 2023.

Reversions decreased by $160 million in fiscal year 2023.

Fund Financial Statements

A fund is a grouping of related accounts used to maintain control over resources that have been segregated for

specific activities or objectives. Fund accounting is used to ensure and demonstrate compliance with finance-

related legal requirements. The Component Appropriation Funds are categorized as governmental funds and

therefore reported using the modified accrual basis of accounting. The financial statements of the Funds

include Balance Sheets and Statements of Revenues, Expenditures and Changes in Fund Balances, which are

reported on pages 14 through 17.

The Funds do not adopt annual appropriated budgets. However, the appropriations of the Funds by law must

equal the individual amounts appropriated in the various Appropriation Acts, which are reported in the Schedule

of Appropriations on pages 37 through 44.

Notes to the Financial Statements

The notes provide additional information that is essential to a full understanding of the data provided in the

fund financial statements. The notes on the financial statements can be found on pages 19 through 29 of this

report.

Other Information

In addition to the financial statements and accompanying notes, this report presents, as other information, the

unaudited Schedule of Balance Sheet and Schedule of Revenues, Expenditures and Fund Balances, which

includes the Tobacco Settlement Permanent Fund and Tax Stabilization Fund. These schedules include the

amount of investments held in the State Investment Council and the net increase/decrease in fair value for

these investments. These numbers are not audited and are presented to show the amount of the investments

held by the State Investment Council to help the reader of the statements understand the position of a fund

that can be used as a reserve to the Component Appropriation Funds. The audited numbers for the Tobacco

Settlement Permanent Fund and Tax Stabilization Fund can be found in the State of New Mexico’s State

Investment Council’s 2023 Financial Statement report located at their website. In addition, other information

includes the Schedule of Revenues by Source and the Schedule of Appropriations. These schedules provide

detailed information on revenues and appropriations to demonstrate legal compliance with the statutes

governing the collection of revenue and disbursements of appropriations by the Component Appropriation

Funds.

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

7

Also presented as other information are the following:

Schedule of Amounts Due to/from Other State Entities

Schedule of Amounts Due from Taxpayers

Schedule of Amounts Due to Local Governments

Schedule of Amounts Due to Taxpayers

Schedule of Transfers In/(Out)

Schedule of Appropriations by Function of Government

Schedule of Amounts Due from Beneficiaries

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

8

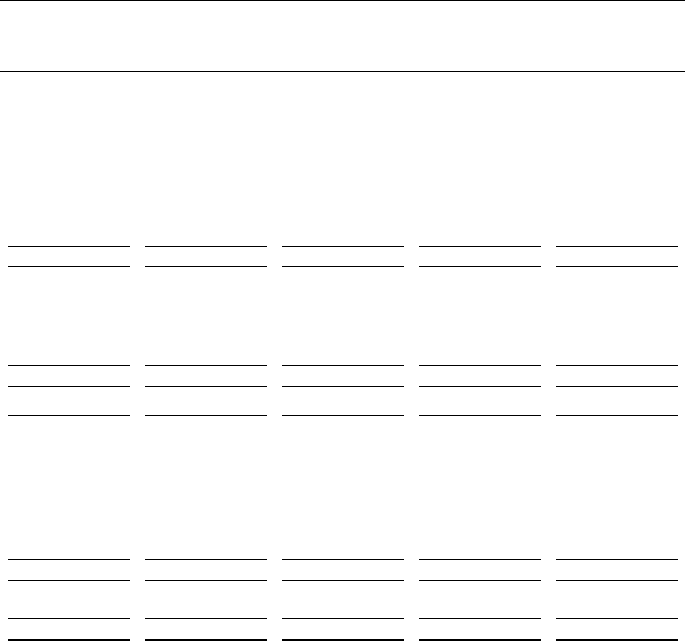

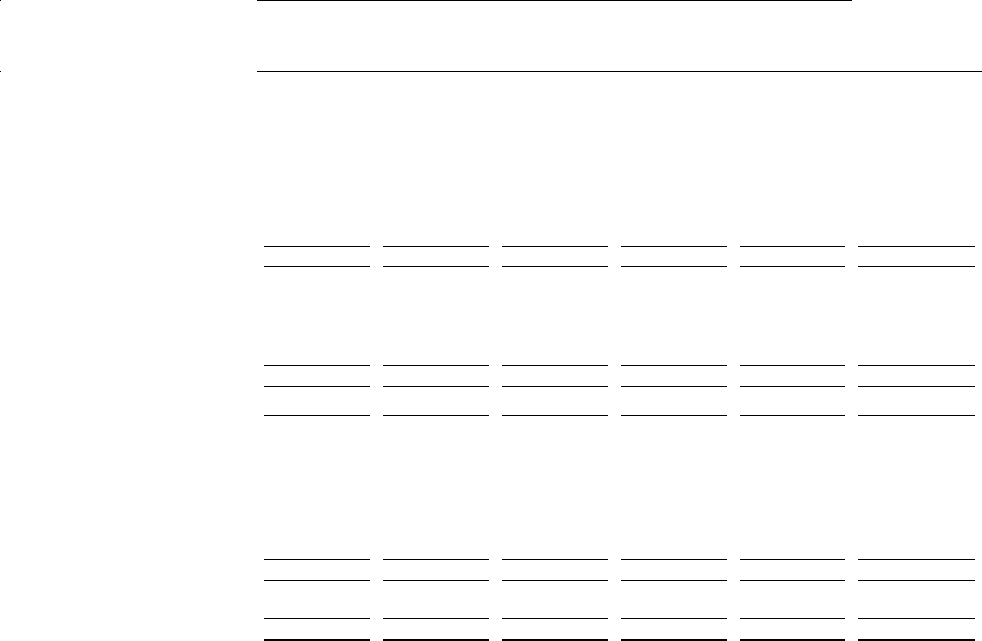

Fund Financial Analysis

The focus of the financial statements of the Funds is on near-term inflows, outflows and balances of spendable

resources. Such information is useful in assessing the financing requirements.

As of the end of the current fiscal year, the Funds reported an aggregate fund balance of $607 million, a

decrease of $19.5 million from fiscal year 2022. Aggregate assets, liabilities, deferred inflows of resources, and

fund balance as of June 30, are as follows:

Aggregate Assets, Liabilities,

Deferred Inflows of Resources, and Fund Balance

June 30, 2023

(in millions of dollars)

2023

2022

Assets

2,857.4$

3,129.6$

Liabilities

(2,186.3)

(2,459.0)

Deferred inflow of resources

(64.1)

(44.1)

Fund balance

607.0$

626.5$

The assets held by the Funds are unappropriated and unassigned except for the State Support Reserve Fund,

which is restricted. At year-end, $64.1 million of assets were classified as deferred inflows and will be

recognized as revenue in the next accounting period. This amount is not considered available for appropriation

in the year ended June 30, 2023.

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

9

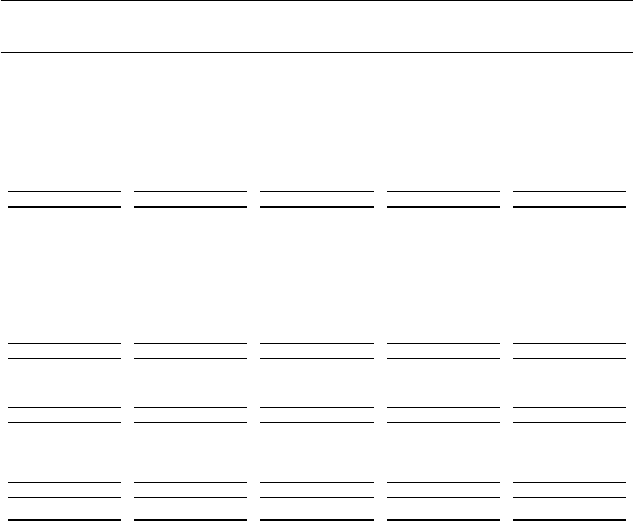

Aggregate Change in Fund Balances

For the Year Ended June 30, 2023

(in millions of dollars)

2023

2022

Increase

(Decrease)

Reve nue s

General and selective taxes

4,809.0$

4,146.8$ 662.2$

Income taxes

2,177.8

1,772.5 405.3

Severance taxes

2,142.1

1,984.4 157.7

License fees

60.7

24.9 35.8

Investment income

181.4

(118.3) 299.7

Rents and royalties

3,270.5

2,328.2 942.3

Miscellaneous receipts

46.9

36.9

10.0

Total revenues

12,688.3

10,175.2

2,513.1

Expenditure s

Appropriations

Higher education

145.0

130.5 14.5

Grants to Public Schools

39.1

-

39.1

Total expenditures

184.1

130.5

53.6

Excess of revenues over expenditures

12,504.2

10,044.7

2,459.5

Othe r Financing Source s (Us e s )

Transfers in - Sources

2,308.7

2,220.8 87.9

Transfers in - Higher Ed. Universities

0.4

0.4 0.0

Transfers out - Appropriations

(10,003.9)

(8,009.0) 1,994.9

Transfers out - Other

(5,020.7)

(4,389.0) 631.7

Reversions

191.7

351.7

(160.0)

Total other financing sources

(12,523.7)

(9,825.1)

2,554.5

Net change in fund balance

(19.5)

219.6 5,014.0

Fund balance - beginning

626.5

406.9

219.6

Fund balance - ending

607.0$

626.5$

(19.5)$

The Funds’ aggregate fund balances decreased by $19.5 million in fiscal year 2023.

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

10

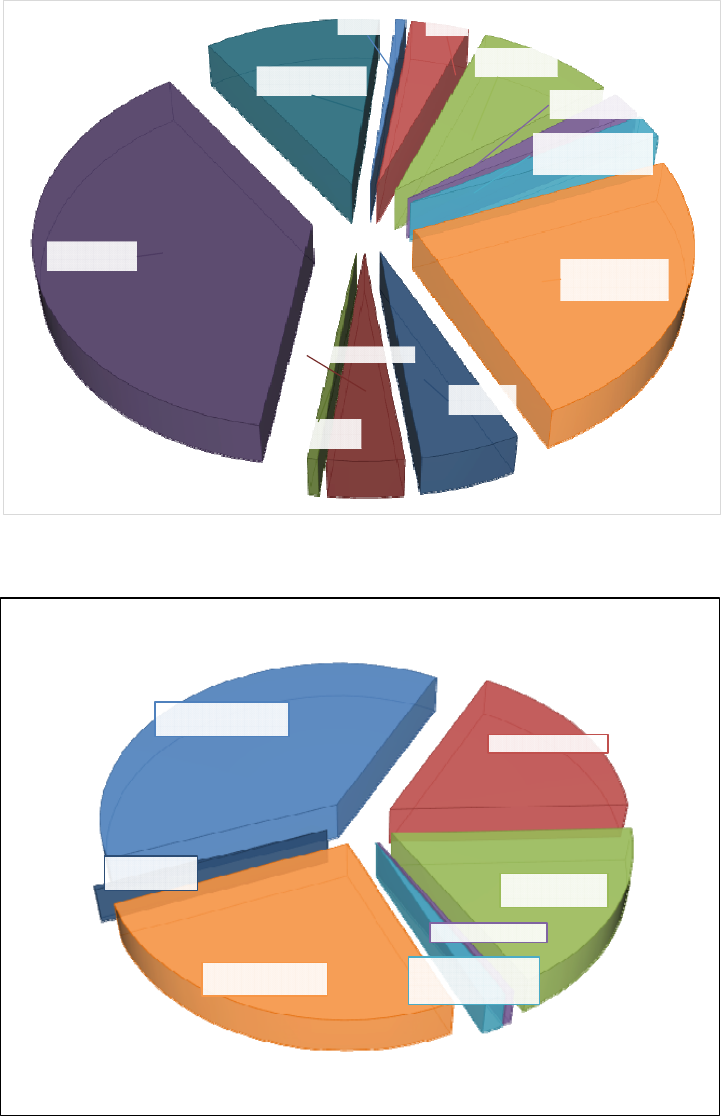

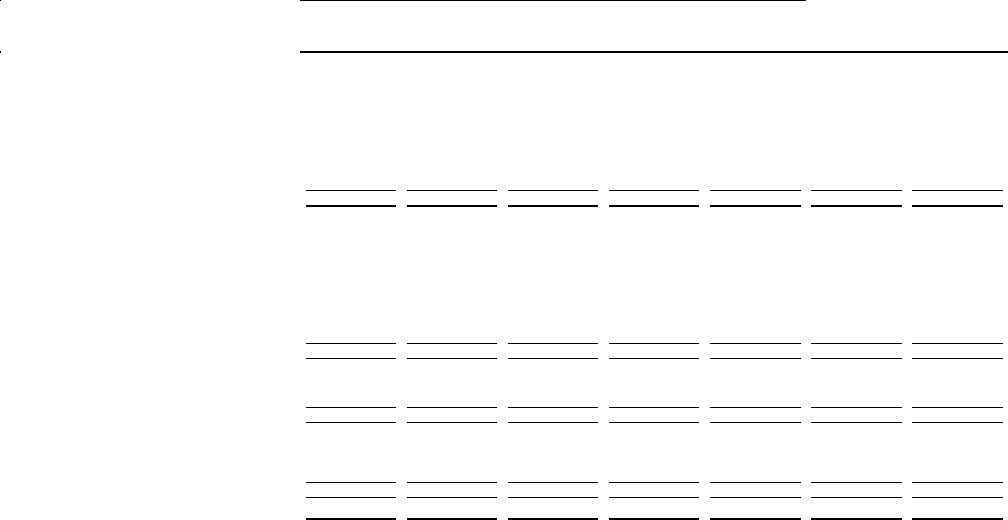

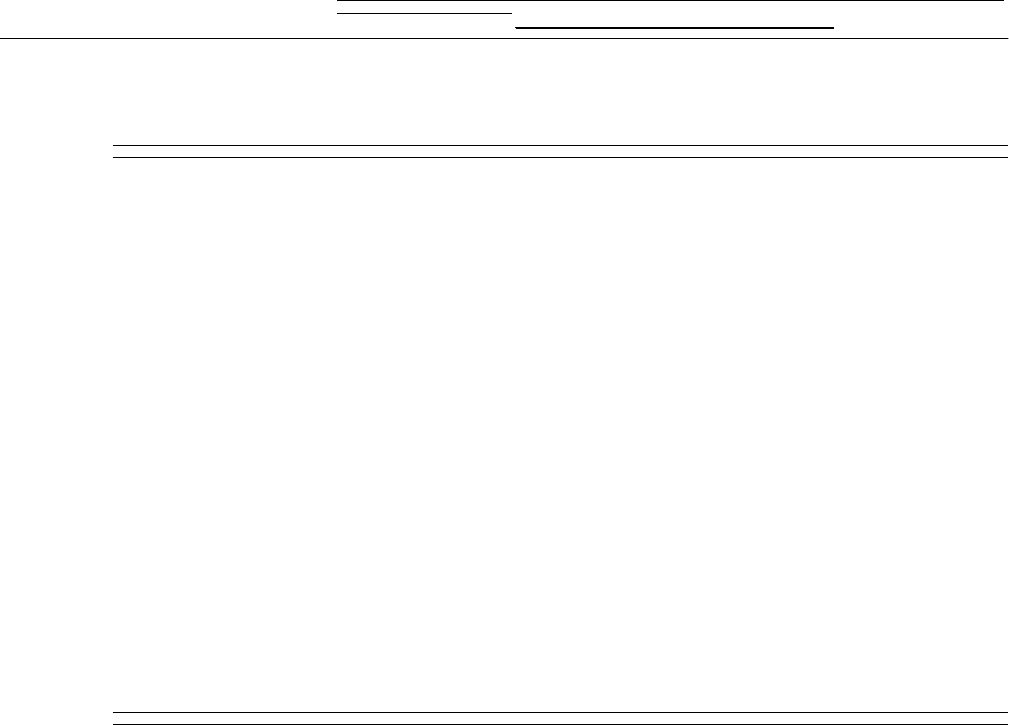

Appropriations by Function

Legi s l ati ve

0.6%

Judicial

3.7%

Generalcontrol

8.8%

Commerce andindustry

2.0%

Agr i cul ture,energy and

na tural resources

2.1%

Health,hospitalsand

humanservices

23.7%

Publi csafety

5.3%

Trans por tati on,4.1%

Othereducati on

0.6%

Highereducatio n

38.0%

Publi cschools upp ort

11.1%

Aggregate Revenues by Source

GeneralandSelective

Taxes,37 .9%

IncomeTa xes,17.1

Sev eranceTa xes ,

16.9%

Li cens eFees, 0.5%

Investment Income,

1.4 %

Rents andRoyalties,

25.8%

Miscellaneous

Receipts,0.4%

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

11

Economic Factors Affecting New Mexico’s Fiscal Year 2023 Budget

New Mexico utilizes a consensus revenue estimating group (CREG) composed of legislative and executive

branch economists to forecast General Fund revenue for the state. The Executive and Legislature work with the

same revenue forecast in preparing their respective General Fund operating budget recommendations. The State

General revenue forecast of the CREG is based on forecasts of the U.S. economy from Moody's Analytics and

S&P, along with the forecasts of New Mexico's economy prepared by the University of New Mexico's Bureau

of Business and Economic Research. Economic inputs also include data and information provided by state

agencies, and other national data sources such as the Energy Information Administration, Bureau of Labor

Statistics, Bureau of Economic Analysis, and the U.S. Census Bureau. Historical information on New Mexico’s

value and volume of crude oil and natural gas produced in the state is derived from the state’s GenTax Database

reporting system. Product price forecasts are derived from national economic forecasting services and other

sources. Additionally, New Mexico’s state revenues are highly sensitive to boom-and-bust cycles in the energy

industry; therefore, the CREG conducts a stress-test on state revenues during the revenue forecasting process.

The establishment and use of stress-testing hedges against an economic downturn or an unforeseen downswing

in the energy sector. Stress-testing allows for targeting appropriate levels of general fund reserves while

simultaneously safeguarding the state’s budget.

Trends in the U.S. Economy

The United States economy experienced growth in state fiscal year 2023, albeit at a slower pace. The national

economy, as measured by real gross domestic product, grew by 1.7% in fiscal year 2023, but was hindered by

record levels of inflation and recessionary fears. Moreover, the moderate growth has been influenced by the

Federal Reserve rate increases that were implemented to curb stubbornly high inflation levels by slowing the

national economy and labor market, without triggering a recession. In fiscal year 2023, total US employment

increased by 3.66 million, this represents a 2.4% year-over-year growth from fiscal year 2022. Average hourly

wages in the U.S. increased by 4.4%, which was below the 6.3% inflation rate, effectively reducing workers'

purchasing power. In fiscal year 2024, wage growth is expected to outpace inflation.

The US economy is anticipated to experience moderate growth in fiscal year 2024, with a projected GDP

growth rate of 1.8%. In response to persistently high inflation and a robust job market, the Federal Reserve is

expected to maintain short-term interest rates high during the near future.

New Mexico Economy

The New Mexico economy showed growth in fiscal year 2023, with the real gross domestic product expanding

by 1.9 percent on a year-over-year basis. The wages and salaries in the state increased by 10.1 percent and the

total personal income grew by 2.5 percent. In the same period, employment in New Mexico increased by 3.4

percent, which means the state added approximately 28,800 jobs. During fiscal year 2023, the Mining,

Construction, Leisure and Hospitality, Education & Health Services, and Local Government sectors created

3,500 jobs, 2,500 jobs, 6,000 jobs, 6,500 jobs, and 6,000 jobs, respectively.

Oil prices were lower in fiscal year 2023 compared to fiscal year 2022. Prices were pressured downwards by

easing concerns about worldwide and national economic growth, the international markets pricing in the

Ukraine-Russia conflict, and recessionary fears slowly receding for the calendar year 2023. The average prices

for crude oil and natural gas in New Mexico were $80.65 per barrel and $5.40 per mcf, respectively. Despite the

State of New Mexico

Component Appropriation Funds

Management’s Discussion and Analysis (Unaudited)

June 30, 2023

12

lower prices, New Mexico maintained its high levels of oil and natural gas production due to low break-even

points and high yield-producing wells. In fiscal year 2023, New Mexico produced a record high of 657.5

million barrels of oil and 3.2 billion cubic feet of natural gas. The record levels of production in fiscal year 2023

offset any impact of the slightly lower prices.

General Fund Revenue and Reserve Outlook

According to the August 2023 consensus revenue estimate, fiscal year 2023 recurring revenue is expected to

have grown by 20.3 percent to over $11.6 billion, while year-end financial reserves are estimated to be 51

percent of recurring appropriations. The growth in the revenue estimate is mainly due to general sales, income

taxes, and investment income performing better than expected. Additionally, growth in revenue driven by oil

and natural gas prices and production is mainly captured by the excess transfers.

Fiscal year 2024 recurring revenues are estimated to increase by 8.3 percent when compared to fiscal year 2023.

Total revenues for fiscal year 2024 are estimated to be around $12.6 billion. Fiscal year 2024 over fiscal year

2023 growth is driven primarily by estimated growth in oil and natural gas revenue. General sales and income

revenue is also growing, however, due to legislative adjustments they decline when compared to fiscal year

2023. The consensus revenue outlook for fiscal year 2024 estimates ending reserves to increase from $3.2

billion to $4.3 billion or 51 percent of recurring appropriations (pending 2024 legislative appropriations).

The global, national, and state economic outlook is still uncertain. The Federal Reserve is taking aggressive

actions to combat inflation, which appears to be working, but continuing to tighten may cause an overcorrection

and an economic slowdown in fiscal year 2024. Other risks include a tight labor market, supply-side constraints,

and potential changes in crude oil production by OPEC+.

Requests for Information

This financial report is designed to provide a general overview of the Funds’ finances for all those with an

interest in its finances. Questions concerning any of the information provided in this report or requests for

additional financial information should be addressed to:

New Mexico State Controller

Department of Finance and Administration

407 Galisteo, Room 166

Bataan Memorial Building

Santa Fe, New Mexico 87501

Financial Statements

The accompanying notes are an integral part of these financial statements.

14

State of New Mexico

Component Appropriation Funds

Balance Sheet

June 30, 2023

71600 71700 85700 85300 85100

Common

School

Current

Current

School

State

Support

Reserve

Appropriation

Account

Federal

Mineral

Leasing

Assets

Investment in State General Fund Investment Pool (Note 2) - - 10,398,802 447,038,346 -

Due from other State General Fund Accounts - - - - -

Due from other State Entities (Note 4) - - - 624,537,891 -

Due from Higher Education Universities - - - 401,661 -

Due from the Tax Payers - - - 64,136,350 -

Due from the Federal Government - - - - 66,120

Due from Component Units - - - 543,793 -

Due from Local Governments

-

- - 41,676 -

Total assets

-

- 10,398,802 1,136,699,717 66,120

Liabilitie s

Due to other State Entities - - - 723,853,059 66,120

Due to other State General Fund Accounts - - - 105,148,273 -

Due to Tax Payers - - - 205,532,935 -

Due to Local Governments - - - 38,029,100 -

Unearned Revenue

-

- - - -

To tal liabilities

-

- - 1,072,563,367 66,120

Deferred Inflow of Resources

Unavailable revenue - taxes

-

- - 64,136,350 -

Total deferred inflow of resources

-

- - 64,136,350 -

Fund Balances

Unassigned - - - - -

Restricted

-

- 10,398,802 - -

To tal fund balances

-

- 10,398,802 - -

Total liabilities, deferred inflows of

resources, and fund balances

-

- 10,398,802 1,136,699,717 66,120

Statutorily Created Funds

Administratively

Created Funds

The accompanying notes are an integral part of these financial statements.

15

State of New Mexico

Component Appropriation Funds

Balance Sheet — continued

June 30, 2023

Statutorily Created

Funds

85400 85200 20730

Appropriation

Contingency

Reserve

General

Operating

Reserve

Excess Extraction

Tax Suspense

Eliminations

Total

June 30, 2023

Assets

Investment in State General Fund Investment Pool (Note 2) 69,011,093 491,435,727 813,780,788 - 1,831,664,756

Due from other State General Fund Accounts - 105,148,273 - (105,148,273) -

Due from other State Entities (Note 4) - - 336,043,785 - 960,581,676

Due from Higher Education Universities - - - - 401,661

Due from the Tax Payers - - - - 64,136,350

Due from the Federal Government - - - - 66,120

Due from Component Units - - - - 543,793

Due from Local Governments

-

- - - 41,676

Total assets

69,011,093

596,584,000 1,149,824,573 (105,148,273) 2,857,436,032

Liabilities

Due to other State Entities - - 1,149,824,573 - 1,873,743,752

Due to other State General Fund Accounts - - - (105,148,273) -

Due to Tax Payers - - - - 205,532,935

Due to Local Governments - - - - 38,029,100

Unearned Revenue

69,011,093

- - - 69,011,093

Total liabilities

69,011,093

- 1,149,824,573 (105,148,273) 2,186,316,880

Deferred Inflow of Resources

Unavailable revenue - taxes

-

- - - 64,136,350

Total deferred inflow of resources

-

- - - 64,136,350

Fund Balance s

Unassigned - 596,584,000 - - 596,584,000

Restricted

-

- - - 10,398,802

To tal fund balances

-

596,584,000 - - 606,982,802

Total liabilities, deferred inflows of

resources, and fund balances

69,011,093

596,584,000 1,149,824,573 (105,148,273) 2,857,436,032

Administratively

Created Funds

The accompanying notes are an integral part of these financial statements.

16

State of New Mexico

Component Appropriation Funds

Statement of Revenues, Expenditures and Changes in Fund Balances

For the Year Ended June 30, 2023

71600 71700 85700 85300 85100

Common

School

Current

Current

School

State

Support

Reserve

Appropriation

Account

Federal

Mineral

Leasing

Re ve nue s

General and selective taxes - - - 4,809,020,548 -

Income taxes - - - 2,177,768,150 -

Severance taxes - - - 992,261,034 -

License fees - - - 60,653,905 -

Investment income - - - 181,381,304 -

Rents and royalties - - - 78,163,246 3,192,349,433

Miscellaneous receipts

-

2,998,788 - 43,859,574 -

Total revenues

-

2,998,788 - 8,343,107,761 3,192,349,433

Expe nditure s

Appropriations

Higher education - - - 144,982,600 -

Grants to Public Schools

-

- 39,092,640 - -

Total expe nd itures

-

- 39,092,640 144,982,600 -

Excess (deficiency) of revenues

over expenditures

-

2,998,788 (39,092,640) 8,198,125,161 3,192,349,433

Othe r Financing Source s (Us es )

Transfers in - Sources 968,901,258 968,901,258 - 265,791,612 -

Transfers in - Higher Ed. Universities - - - 401,661 -

Transfers out - Appropriations - (971,900,046) - (7,825,407,144) (1,119,372,233)

Transfers out - Other (968,901,258) - - (829,001,332) (2,072,977,200)

Reversions - FY23

-

- - 190,090,042 -

Total other financing sources (uses)

-

(2,998,788) - (8,198,125,161) (3,192,349,433)

Net change in fund balance - - (39,092,640) - -

Fund balances - beginning of year

-

- 49,491,442 - -

Fund balances - end of year

-

- 10,398,802 - -

Statutorily Created Funds

Administratively

Created Funds

The accompanying notes are an integral part of these financial statements.

17

State of New Mexico

Component Appropriation Funds

Statement of Revenues, Expenditures and Changes in Fund Balances — continued

For the Year Ended June 30, 2023

Statutorily Created

Funds

85400 85200 20730

Appropriation

Contingency

Reserve

General

Operating

Reserve

Excess Extraction

Tax Suspense

Total

June 30, 2023

Re ve nues

General and selective taxes - - - 4,809,020,548

Income taxes - - - 2,177,768,150

Severance taxes - - 1,149,824,573 2,142,085,607

License fees - - - 60,653,905

Investment income - - - 181,381,304

Rents and royalties - - - 3,270,512,679

Miscellaneous receipts

-

- - 46,858,362

Total revenues

-

- 1,149,824,573 12,688,280,555

Expe nditure s

Appropriations

Higher education - - - 144,982,600

Grants to Public Schools

-

- - 39,092,640

Total expenditures

-

- - 184,075,240

Excess (deficiency) of revenues

over expenditures

-

- 1,149,824,573 12,504,205,315

Othe r Financing Source s (Us es )

Transfers in - Sources - 105,148,273 - 2,308,742,401

Transfers in - Higher Ed. Universities - - - 401,661

Transfers out - Appropriations (12,793,727) (74,396,273) - (10,003,869,423)

Transfers out - Other - - (1,149,824,573) (5,020,704,363)

Reversions - FY23

1,628,822

- - 191,718,864

Total other financing sources (uses)

(11,164,905)

30,752,000 (1,149,824,573) (12,523,710,860)

Net change in fund balance (11,164,905) 30,752,000 - (19,505,545)

Fund balances - beginning of year

11,164,905

565,832,000 - 626,488,347

Fund balances - end of year

-

596,584,000 - 606,982,802

Administratively

Created Funds

Notes to the Financial Statements

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

19

1) Summary of Significant Accounting Policies

A. Reporting Entity

The accompanying financial statements report eight statutorily and administratively

created funds administered by the Department of Finance and Administration of the

State of New Mexico. The funds are referred to as “Component Appropriation Funds”

(the “Funds”). Together with many other statutorily and administratively created funds,

they comprise the General Fund of the State of New Mexico, which is presented in the

State of New Mexico’s Annual Comprehensive Financial Report.

The Funds do not constitute a primary government, component unit, or any other type of

reporting entity as defined by generally accepted accounting principles.

Taken together, the Funds present the primary revenue and financing of the activities of

the State of New Mexico. As such, the Legislature, state officials and the citizens of the

State of New Mexico, as well as other groups such as bond issuers and rating services,

have an interest in the operations of the Funds. The accompanying financial statements

are presented to meet those needs. The Tobacco Settlement Permanent Fund and Tax

Stabilization Fund, which are managed and reported by the N.M. State Investment

Council (SIC) are considered reserve funds of the Component Appropriations Funds.

These funds are not audited and are presented to show the amount of the investments

held by the State Investment Council to help the reader of the statements understand the

position of the funds that can be used as a reserve to the Component Appropriation

Funds. The audited numbers for the Tobacco Settlement Permanent Fund and Tax

Stabilization Fund can be found in the State of New Mexico’s State Investment

Council’s 2023 Financial Statement report located at their website.

The following is a description of the eight statutorily and administratively created

funds.

Statutorily Created Funds

1. Common School Current Fund – SHARE Fund 71600

The Common School Current Fund (also known as the Common School Income

Fund) was created by Section 19-1-17, NMSA 1978. This statute requires that the

fund be credited with its respective proportion of money from the State Land Income

Fund and the State Permanent Fund. Section 22-8-32, NMSA 1978, requires that at

the end of each month, the state treasurer transfer out the cash balance in this fund

to the Current School Fund. In fiscal year 2023, other financing sources were

reported in this fund before transferring the balance to the Current School Fund per

22-8-32, NMSA 1978.

2. Current School Fund – SHARE Fund 71700

The Current School Fund was created by Section 22-8-32, NMSA 1978. This statute

requires the state treasurer to deposit into this fund: 1) all fines and forfeitures

collected under general laws; 2) the net proceeds of property that may come to the

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

20

state by escheat (however, Section 7-8A-13, NMSA 1978, requires all funds received

under the Unclaimed Property Act to be deposited in the tax administration suspense

fund for distribution to the General Fund); and 3) all other revenue required by law

to be credited to the fund. In addition, as noted above, the statute requires that each

month the cash balance in the Common School Current Fund be transferred into this

fund.

In addition to the above, Section 22-8-32 requires any unencumbered balance in this

fund to be transferred out to the Public- S c h o o l Fund—a statutorily created fund

administered by both the Public Education Department and the Component

Appropriation Funds.

3. State Support Reserve Fund – SHARE Fund 85700

The State Support Reserve Fund was created by Section 22-8-31, NMSA 1978. This

statute requires the following: The State Support Reserve Fund shall be used only to

augment the appropriations for the state equalization guarantee distribution in order to

ensure, to the extent of the amount undistributed in the fund, that the maximum

figures for such distribution established by law shall not be reduced. The fund balance

on June 30, 2023, was $10,398,802 and is restricted based on the statute that created

the fund.

4. Excess Extraction Tax Fund – SHARE Fund 20730

The Excess Extraction Suspense Fund was created by Section 6-4-27, NMSA 1978.

This statute requires excess emergency oil & gas taxes to be held in suspense until

state reserves are calculated by DFA at year-end. The balance of this fund must be

transferred to the Tax Stabilization or Early Childhood Education and Care Fund

depending on reserve levels.

Administratively Created Funds

1. Appropriation Account Fund – SHARE Fund 85300

The Appropriation Account Fund is an administratively created fund the Component

Appropriation Funds uses to account for the financial activity of the statutorily

created General Fund and for portions of the financial activity of the statutorily

created Public School Fund of the State of New Mexico.

State statute, Section 6-4-2, NMSA 1978, creates the General Fund and requires

the state treasurer to credit all revenues, not otherwise allocated, to the fund. In

addition, the statute requires that expenditures from the fund be made only in

accordance with appropriations authorized by the Legislature. Those appropriations

result in allotments of cash from the General Fund. The allotments are presented as

transfers in the accompanying financial statements.

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

21

Section 22-8-14, NMSA 1978, creates the Public School Fund. The Component

Appropriation Funds administers three financial activities of that fund; all other

activities of the fund are administered by the Public Education Department.

One of those activities administered by the Component Appropriation Funds is the

transfer from the Current School Fund to the Public School Fund required by Section

22-8-32, NMSA 1978. The Component Appropriation Funds administers the other

two activities through its Federal Mineral Leasing Fund (see item 2 below). Those

activities include receiving receipts under the Federal Minerals Land Act, 30 USC

181 (the General Appropriation Act defines General Fund to include Federal

Mineral Leasing Act receipts) and allotting cash, based on legislative appropriations,

from the Public School Fund to the Instructional Materials Fund and to the Bureau

of Mines and Mineral Resources of the New Mexico Institute of Mining and

Technology.

The transfer described in the previous paragraph reduces (offsets) the appropriation

and related cash allotments that have been made from the General Fund to the

portion of the Public School Fund administered by the Public Education Department.

The General Appropriations Act requires that the appropriation from the General

Fund to the portion of the Public School Fund administered by the Public Education

Department be reduced by the amounts transferred to the Public School Fund from

the Current School Fund. Expenditures will be presented as transfers in these

financial statements.

2. Federal Mineral Leasing Fund – SHARE Fund 85100

As noted above, the Component Appropriation Funds administers two other activities

of the Public School Fund through its administratively created Federal Mineral

Leasing Fund. Those activities include receiving receipts under the Federal Minerals

Land Act, 30 USC 181, and allotting cash—based on legislative appropriation—from

the portion of the Public School Fund administered by the Component Appropriation

Funds to the Instructional Materials Fund and to the Bureau of Mines and Mineral

Resources of the New Mexico Institute of Mining and Technology.

Like the transfer in from the Current School Fund, the receipts from the Federal

Minerals Land Act, 30 USC 181 reduce (offset) the appropriation and related cash

allotments that have been made from the General Fund to fund a portion of the

Public School Fund administered by the Public Education Department. As noted

above, the General Appropriations Act requires that the appropriation from the

General Fund to the portion of the Public School Fund administered by the Public

Education Department be reduced by the amount of Federal Minerals Land Act

receipts. Expenditures will be presented as transfers in these financial statements.

The General Appropriations Act is consistent with Section 22-8-34, NMSA 1978, in

that Section 22-8-34 requires the state treasurer to deposit all money received under

the Federal Mineral Lands Leasing Act to the Public School Fund, except for the

following: 1) that portion appropriated to the Instructional Materials Fund and to the

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

22

Bureau of Mines and Mineral Resources of the New Mexico Institute of Mining and

Technology; and 2) the remainder of any prepayments after deducting the amount

that the state would have received as its share of royalties during the fiscal year. (The

statute requires that the remainder be distributed to the Common School Permanent

Fund.) Section 9-29A-3, NMSA 1978 requires excess revenues over the 5-year

average be transferred to the early childhood and education care fund.

3. Appropriation Contingency Reserve Fund – SHARE Fund 85400

Section 6-4-2.3, NMSA 1978, creates the appropriation contingency reserve within

the General Fund. To account for the reserve, the Component Appropriation Funds

has established the Appropriation Contingency Reserve Fund. Section 6-4-2.3

includes the following requirements: The appropriation contingency reserve may be

expended only upon specific authorization by the legislature or as provided in

Sections 6-7-1 through 6-7-3 NMSA 1978 in the event there is no surplus of

unappropriated money in the General Fund. The fund balance on June 30, 2023, was

$0.

4. General Operating Reserve Fund – SHARE Fund 85200

Section 6-4-2.1, NMSA 1978, creates the General Operating Reserve Fund within the

General Fund. To account for the reserve, the Component Appropriation Funds has

established the General Operating Reserve Fund. Section 6-4-4, NMSA 1978,

requires that excess revenue over appropriations (expenditures) in the General Fund

be transferred to the General Operating Reserve Fund provided that if the sum of the

excess revenue plus the balance in the operating reserve prior to the transfer is greater

than eight percent of the aggregate recurring appropriations from the General Fund

for the previous fiscal year, then an amount equal to the smaller of either the amount

of the excess revenue or the difference between the sum and eight percent of the

aggregate recurring appropriation from the General Fund for the previous fiscal year

shall be transferred to the Tax Stabilization Fund. Expenditures will be presented as

transfers in these financial statements.

The General Operating Reserve Fund may be expended only upon specific

authorization by the legislature and only in the event General Fund revenues and

fund balances, including all other transfers to the General Fund authorized by law,

are insufficient to meet the level of appropriations authorized. The fund balance on

June 30, 2023, was $596,584,000 and was reported as unassigned.

B. Basis of Accounting and Presentation

The financial statements of the Funds have been prepared in accordance with accounting

principles generally accepted in the United States of America as applied to governmental

units and funds. The Governmental Accounting Standards Board (GASB) is the standard-

setting body for governmental accounting and financial reporting.

Fund Financial Statements - Each of the Funds is reported as Governmental Funds.

Accordingly, they are reported using the current financial resources measurement focus

and the modified accrual basis of accounting. Revenues are recognized as soon as they

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

23

are both measurable and available. For derived tax revenues, related assets are recognized

when the exchange transaction occurs or when the resources are received, whichever

occurs first. Revenues are available when they are collectible within the current period or

soon enough thereafter to pay liabilities of the current period. For this purpose, the Funds

consider tax revenues to be available if they are collected within 60 days after the end of

the fiscal year. Unavailable revenues are reported when assets, such as taxes, are obtained

prior to revenue being recognized.

Escheats are not considered susceptible to accrual and are therefore recognized when

received. Reversions are recognized as transfers if collected within 90 days of the end

of the current fiscal period and all other revenues are available if collected prior to

completion of the Funds’ financial statements, typically by November 15

th

following

the end of the fiscal year. Appropriations generally are recorded when a liability is

incurred.

C. Assets, Deferred Outflow of Resources, Liabilities, and Deferred Inflow of Resources

1. Due from Other State Entities — Section 6-4-2, NMSA 1978, requires all revenues

not otherwise allocated by law to be credited to the Component Appropriation Funds.

In addition, Section 6-5-10, NMSA 1978, requires all unassigned fund balances in

reverting state agency funds to be reverted to the Component Appropriation Funds.

Various state agencies collect revenues on behalf of the Component Appropriation

Funds. In addition, most state agencies administer funds that revert balances to the

Funds.

2. Due to Local Governments — the amounts due to local governments reported in the

accompanying financial statements are 1/12 of the annual appropriation amounts due

to local governments. This is a timing difference and the amounts due to local

governments are paid within 30 days of the fiscal year-end.

3. Due from Taxpayers and Unavailable Revenues — GASB Statement No. 65, Items

Previously Reported as Assets and Liabilities (GASB 65) states that when an asset is

recorded in Governmental Fund financial statements, but the revenue is not available,

the government should report a deferred inflow of resources until such time as the

revenue becomes available. Amounts due from taxpayers for fiscal year 2023 taxes,

which are not readily available until more than 60 days after the fiscal year-end, are

recorded as deferred inflow of resources.

4. Use of Resources — when both restricted and unrestricted resources are available for

use, it is the Component Appropriation Funds’ policy to use restricted resources first

and then unrestricted resources as they are needed.

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

24

5. Interfund Activity — the effect of interfund activity between these eight statutorily

and administratively created funds has been eliminated from the Funds’ totals in the

accompanying financial statements. This interfund activity included the receivables

and payables listed in the table below.

Name

SHARE

System Fund

Number

Name

SHARE

System Fund

Number

Amount

General Operating Reserve 85200 Appropriations Accounts Fund 85300

105,148,273$

105,148,273$

Due to Other Funds (providing)Due from Other Funds (receiving)

D. Revenues, Appropriations, Expenditures and Reversions

1. Reversions — once an appropriation lapses, the unspent cash balance is usually

required by law to be returned to the fund from where the appropriation allotment

originated (that is, from where the cash related to the appropriation originated). In the

accompanying financial statements, the cash returned to the Funds is treated as other

financing sources and presented as “reversions.”

2. Revenues — the Component Appropriation Funds account for the financial resources

of the state except those required to be accounted for by a fund within another state

entity. Proceeds are collected by various agencies of the state and held within a

governmental fund at NM Taxation and Revenue Department to be transferred to one

of the Component Appropriation Funds for revenue recognition. Revenues are

available when they are collectible within the current period or soon enough

thereafter to pay liabilities of the current period.

3. Expenditures/Transfers — appropriations represent legislatively approved transfers of

budgeted funds to state entities for the necessities of operations. In the accompanying

financial statements, appropriations sent to external entities are treated as

expenditures and all other appropriations sent to State entities and component units

are treated as other financing uses and presented as “appropriations”.

E. Fund Balances

In accordance with Governmental Accounting Standards Board (GASB) Statement No.

54, Fund Balance Reporting and Governmental Fund Type Definitions, fund balance

classifications are based upon the extent to which a government is bound to follow

constraints on resources in governmental funds and are classified as restricted or

unassigned.

Restricted fund balance represents those portions of fund balance where constraints are

placed on resources, either externally or by law through constitutional provisions or

enabling legislation. Unassigned fund balance is the residual amount after all

classifications were considered.

The accompanying financial statements report restricted fund balance in the State

Support Reserve Fund because the balance is legally restricted for specific purposes.

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

25

F. Budgets

Annually, the Governor is required to submit a balanced budget by Program Code (P-

Code) to the Legislature. The Legislature authorizes expenditures in the annual

Appropriations Act by source, which is signed into law by the Governor. Annual

appropriations lapse at fiscal year-end. In the event actual revenues are insufficient to

cover budgeted expenditures, the Governor must order budget reductions or call a special

session of the Legislature to address the budget issues. Adjustments to the budget may

also be made throughout the year for changes in program revenues so that departments

and funds will not end the fiscal year in a deficit position. Expenditures are controlled at

the program appropriation unit level. The budget is adopted on a budgetary basis that is

not consistent with GAAP. The appropriations of the Component Appropriation Funds by

law must equal the individual amounts appropriated in the various Appropriation Acts.

2) Investment in State General Fund Investment Pool

State law (Section 8-6-3 NMSA 1978) requires investments of the Funds be managed by

the New Mexico State Treasurer’s Office. The investments managed by the State

Treasurer’s Office consist of an interest in the State General Fund Investment Pool

managed by the New Mexico State Treasurer’s Office, which is accounted for as cash

and cash equivalents. See the New Mexico State Treasurer’s Office audited financial

statements via the NM Office of the State Auditor’s website for further information.

As of June 30, 2023, the Funds had the following investments:

Description Maturitie s Fair Value

New Mexico State Treasurer's Office General Fund Investment Pool 1 day to 5 years

1,831,664,756$

Interest Rate Risk

The New Mexico State Treasurer’s Office has an investment policy that limits

investment maturities to five years or less on allowable investments. This policy is a

means of managing exposure to fair value losses arising from increasing interest rates.

This policy is reviewed and approved annually by the New Mexico State Board of

Finance.

Credit Risk

The New Mexico State Treasurer pools are not rated. For additional GASB Statement

No. 40, Deposit and Investment Risk Disclosures-An Amendment of GASB Statement No.

3, disclosure information regarding cash held by the New Mexico State Treasurer, the

reader should refer to the separate audit reports for the New Mexico State Treasurer’s

Office for the fiscal year ended June 30, 2023. The Funds do not have an investment

policy that limits investment maturities as a means of managing its exposure to fair value

losses arising from increasing interest rates.

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

26

3) Advance from the State General Fund Investment Pool

The Appropriation Account Fund disburses allotted appropriations to various entities

based on New Mexico Legislative Appropriation Acts, in anticipation of the collection

of tax revenues, fees and other sources. The State General Fund Investment Pool makes

advances to the Appropriation Account Fund to the extent that such sources have not

yet been collected. There were no advance to the Appropriation Account Fund as of

June 30, 2023.

4) Due to/from Other State Entities

Various state agencies collect revenues on behalf of the Funds. Resulting aggregate

amounts due from state entities are composed of the following on June 30, 2023, which

also reflect amounts owed to 3

rd

parties:

Agency Fund Source Amount

33300 27900 Corporate Income Tax 63,291,961$

33300 64200 Personal Income Tax 31,195,174

33300 71960 Gross Receipts Tax 2,822,222

33300 82500 Weight Distance Tax (148,742) *

33300 82800 Various Taxes & Fees 13,414,605

33300 83100 Worker's Compensation (74,855) *

33300 67940 Taxes & Surcharges 385,675,090

33300 83300 Severance & Excise Tax 359,974,926

33300 83800 Insurance Tax 85,233,129

39400 02000 Tribal Revenue Sharing 19,134,162

39401 80100 Investment Earnings 61,959

44000 11820 Insurance Collections

2,045

960,581,676$

*The negative receivable balance represents unidentified deposits that are remitted to

the Funds as required by State statute(s).

Resulting aggregate amounts due to state entities are composed of the following on

June 30, 2023:

Agency Description Amount

33700 State Investment Council

1,873,743,752$

Total amounts due to other state entities

1,873,743,752$

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

27

5) Transfers

For fiscal year 2023, the legislature did not authorize any additional transfers.

6) State General Fund Investment Pool Reconciliation

The state maintains a short-term investment “pool,” the State General Fund Investment

Pool (SGFIP). The investment pool is managed by the New Mexico State Treasurer’s

Office (STO).

For cash management and investment purposes, funds of various state agencies are

deposited in the SGFIP, which is managed by STO. The SGFIP is not a part of the

accompanying financial statements but is reported as a fiduciary fund in the financial

statements of STO. Claims on the SGFIP are reported as assets by the various agencies

investing in the SGFIP. By statute, the DFA is responsible for reconciling the SGFIP

balances. As of June 30, 2023, the Component Appropriations Funds report an

aggregate investment of $1,831,664,756 in the SGFIP (see Note 2).

The state controller indicated on August 20, 2023, that resources held in the pool were

equivalent to the corresponding business unit claims on those resources and that all

claims as recorded in SHARE shall be honored at face value.

7) Financial Reporting and Disclosure for Multiple-Employer Cost Sharing

Pension Plans by Employees

The Component Appropriations Funds, as part of the primary government of the State of

New Mexico, is a contributing employer to a cost-sharing multiple employer defined

benefit pension plan administered by the Public Employees Retirement Association

(PERA). Disclosure requirements for Governmental Funds apply to the primary

government, and as such, this information will be presented in the Annual

Comprehensive Finance Report (ACFR) of the State of New Mexico.

Information concerning the net pension liability, pension expense, and pension-related

deferred inflows and outflows of resources of the primary government will be contained

in the ACFR and will be on the Department of Finance and Administration’s home page

or at https://www.nmdfa.state.nm.us/new-mexico-annualreport/.

8) Postemployment Benefits - State Retiree Health Care Plan

The Component Appropriations Funds, as part of the primary government of the State of

New Mexico, is a contributing employer to a cost-sharing multiple-employer defined

benefit postemployment health care plan that provides comprehensive group health

insurance for persons who have retired from certain public service positions in New

Mexico. The other postemployment benefits (OPEB) Plan is administered by the Retiree

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

28

Health Care Authority of the State of New Mexico. All required disclosures will be

presented in the ACFR of the State of New Mexico.

Information concerning the net liability, benefit expense, and benefit-related deferred

inflows and deferred outflows of resources of the primary government will be contained

in the State of New Mexico ACFR for the year ended June 30, 2023, and will be

available, when issued, from the Office of the State Controller, Room 166, Bataan

Memorial Building, 407 Galisteo Street, Santa Fe, New Mexico, 87501.

9) Contingencies

A. Pending or Threatened Litigation

There are various protests and lawsuits by taxpayers and other parties claiming

abatements, refunds, and the recovery of unclaimed property in the State Taxation and

Revenue Department’s (“TRD”) possession relating to various programs administered by

TRD. The total dollar amount representing the claims in protest with TRD is estimated to

be $477.6 million. Readers can refer to the published fiscal year 2023 TRD audit for

additional information on outstanding claims or lawsuits. Liabilities arising from these

lawsuits would be paid out of TRD’s current tax collections, which would reduce the

distribution sent to the State General Fund.

B.State Support Reserve Fund – Contingent Liability

The NM Public Education Department received $20.9 million from the General Fund per

the Laws of 2021, Chapter 137, Section 6, Item 16. Based on the Laws of 2021, the

Department created a contingent liability in Fund 85700 until the Secretary of Public

Education determined that a final decision by the United States Department of Education

had been made. This decision was made in fiscal year 2023 and the liability was released

as of June 30, 2023.

10) Federal CARES/ARPA Funding

The Laws of 2021, 2nd Special session, Chapter 4, Section 1 transferred the remaining

balance of approximately $1 billion in SLFRF to the appropriation contingency fund

(Fund 85400) for the purpose of appropriating additional expenditure. These funds are

recorded as unearned revenue until appropriated by the legislature and transferred to the

recipient entity at which time the unearned revenue of Fund 85400 is reduced. The

balance of these unearned revenues as of June 30, 2023, was $69 million.

State of New Mexico

Component Appropriation Funds

Notes to the Financial Statements

June 30, 2023

29

11) Fiscal Year 2023 Personal Income Tax Rebates

The Laws of 2023, Chapter 211, Section 11 provides relief payments defined as tax

rebates to eligible taxpayers who have filed their tax return for taxable year 2021 and

who are not a dependent of another individual that is eligible for a tax rebate.

The amount of this rebate was $500 for single individuals and married individuals filing

separate returns; or $1,000 for heads of households, surviving spouses and married

individuals filing joint returns. The rebates were disbursed as soon as practical after a

return was received; provided that a rebate shall not be allowed for a return filed after

May 31, 2024.

These rebates were recorded as a reduction to Fiscal Year 2023 General Fund revenue.

The total amount of revenue reduced was $694.8 million. The remaining allowable

rebates will be disbursed during fiscal year 2024. In addition, rebates in the amount of

$9.1 million have been held by the New Mexico Taxation & Revenue Department

pending the outcome of researching amounts potentially owed to the State for other

obligations. Once a determination is made, these rebates will be sent to the taxpayer,

abated, or distributed to the statutory recipient of the associated tax.

Other Information (Unaudited)

31

State of New Mexico

Component Appropriation Funds

Schedule of Statutorily and Administratively Created Funds (including the Unaudited

Tobacco Settlement Permanent Fund & Tax Stabilization Fund) — Balance Sheets

June 30, 2023

Statutorily Created Funds

Administratively

Created Funds

C ommo n

School

Current

Current

School

State

Support

Reserve

Appropriation

Account

Federal

Mineral

Leasing

Assets

Investment in State General Fund Investment Pool (Note 2) - - 10,398,802 447,038,346 -

Investments, State Investment C ouncil - - - - -

Due from other state general fund accounts - - - - -

Due from other State Entities (Note 4) - - - 624,537,891 -

Due from Higher Education Universities - - - 401,661 -

Due from the Tax Payers - - - 64,136,350 -

Due from the Federal Government - - - - 66,120

Due from Component Units - - - 543,793 -

Due from Local Governments

-

- - 41,676 -

Total assets

-

- 10,398,802 1,136,699,717 66,120

Liabilities

Receipts held in suspense - - - - -

Due to other State Entities - - - 723,853,059 66,120

Due to other State General Fund accounts - - - 105,148,273 -

Due to other SIC funds - - - - -

Due to Brokers - - - - -

Due to Tax Payers - - - 205,532,935 -

Due to Local Governments - - - 38,029,100 -

Unearned Revenue

-

- - - -

To tal lia bilities

-

- - 1,072,563,367 66,120

Deferred Inflow of Resources

Unavailable revenue - taxes

-

- - 64,136,350 -

Total deferred inflow of resources

-

- - 64,136,350 -

Fund Balance s

Unassigned - - - - -

Restricted

-

- 10,398,802 - -

To tal fund b ala nc es

-

- 10,398,802 - -

To tal lia bilities, de ferred inflo ws of

resources, and fund balances

-

- 10,398,802 1,136,699,717 66,120

SHARE system fund number 71600 71700 85700 85300 85100

32

State of New Mexico

Component Appropriation Funds

Schedule of Statutorily and Administratively Created Funds (including the Unaudited

Tobacco Settlement Permanent Fund & Tax Stabilization Fund) — Balance Sheets —

continued

June 30, 2023

Statutorily Created

Funds

Appropriation

Contingency

Reserve

General

Operating

Reserve

Excess Extraction Tax

Suspense

Tax

Stabilization

Reserve

Tobacco Settlement

Permanent

Elimina tio ns

Total

June 30, 2023

(Memorandum

Only)

Assets

Investment in State General Fund Investment Pool (Note 2) 69,011,093 491,435,727 813,780,788 - - - 1,831,664,756

Investments, State Investment Council - - - 2,396,166,843 346,469,446 - 2,742,636,289

Due from other state general fund accounts - 105,148,273 - - - (105,148,273) -

Due from other State Entities (Note 4) - - 336,043,785 723,853,059 - - 1,684,434,735

Due from Higher Education Universities - - - - - - 401,661

Due from the Tax Payers - - - - - - 64,136,350

Due from the Federal Government - - - - - - 66,120

Due from Component Units - - - - - - 543,793

Due from Local Governments

-

- - - - - 41,676

Total assets

69,011,093

596,584,000 1,149,824,573 3,120,019,902 346,469,446 (105,148,273) 6,323,925,380

Liabilities

Receipts held in suspense - - - - 13,000,000 - 13,000,000

Due to other State Entities - - 1,149,824,573 - - - 1,873,743,752

Due to other State General Fund accounts - - - - - (105,148,273) -

Due to other S IC funds - - - 378,744 47,159 - 425,903

Due to Brokers - - - 69,202,390 2,595,920 - 71,798,310

Due to Tax Payers - - - - - - 205,532,935

Due to Local Governments - - - - - - 38,029,100

Unearned Revenue

69,011,093

- - - - - 69,011,093

Tot al liab ilitie s

69,011,093

- 1,149,824,573 69,581,134 15,643,079 (105,148,273) 2,271,541,093

Deferred Inflow of Re sources

Unavailable revenue - taxes

-

- - - - - 64,136,350

Total deferred inflow of resources

-

- - - - - 64,136,350

Fund Balance s

Unassigned - 596,584,000 - - - - 596,584,000

Restricted

-

- - 3,050,438,768 330,826,367 - 3,391,663,937

To tal fund balanc es

-

596,584,000 - 3,050,438,768 330,826,367 - 3,988,247,937

Tot al liab ilitie s, d efer re d inflo ws of

resources, and fund balances

69,011,093

596,584,000 1,149,824,573 3,120,019,902 346,469,446 (105,148,273) 6,323,925,380

SHARE system fund number 85400 85200 20730 20950 95200

UNAUDITED*

Administratively

Created Funds

*NM State Investment Council (SIC)

33

State of New Mexico

Component Appropriation Funds

Schedule of Statutorily and Administratively Created Funds (including the Unaudited

Tobacco Settlement Permanent Fund & Tax Stabilization Fund — Revenues, Expenditures

and Changes in Fund Balances

For the Year Ended June 30, 2023

Statutorily Created Funds

Administratively

Created Funds

Commo n

School

Current

Current

School

State

Support

Reserve

Appropriation

Account

Federal

Mineral

Leasing

Revenue s

General and selective taxes - - - 4,809,020,548 -

Income taxes - - - 2,177,768,150 -

Severance taxes - - - 992,261,034 -

License fees - - - 60,653,905 -

Investment income - - - 181,381,304 -

Net increase in fair va lue of investments - - - - -

Rents and royalties - - - 78,163,246 3,192,349,433

Miscellaneous receipts

-

2,998,788 - 43,859,574 -

-

2,998,788 - 8,343,107,761 3,192,349,433

Expenditures

Appropriations

Higher education - - - 144,982,600 -

Grants to Public Schools

-

- 39,092,640 - -

Total expenditures

-

- 39,092,640 144,982,600 -

Excess (deficiency) of revenues

over expenditures

-

2,998,788 (39,092,640) 8,198,125,161 3,192,349,433

Other Financing Sources (Uses)

Transfers in - Sources 968,901,258 968,901,258 - 265,791,612 -

Transfers in - Higher Ed. Universities - - - 401,661 -

Transfers out - Appropriations - (971,900,046) - (7,825,407,144) (1,119,372,233)

Transfers out - Other (968,901,258) - - (829,001,332) (2,072,977,200)

Reversions

-

- - 190,090,042 -

Total other financing sources (uses)

-

(2,998,788) - (8,198,125,161) (3,192,349,433)

Net change in fund balance - - (39,092,640) - -

Fund balances - beginning of year

-

- 49,491,442 - -

Fund balances - end of year

-

- 10,398,802 - -

SHARE system fund numbers 71600 71700 85700 85300 85100

34

State of New Mexico

Component Appropriation Funds

Schedule of Statutorily and Administratively Created Funds (including the Unaudited

Tobacco Settlement Permanent Fund & Tax Stabilization Fund) — Revenues,

Expenditures and Changes in Fund Balances — continued

For the Year Ended June 30, 2023

Statutorily Created

Funds

Appropriation

Contingency

Reserve

General

Operating

Reserve

Excess Extraction

Tax Suspense

Tax

Stabilization

Reserve

Tobacco Settlement

Permanent

Total

June 30, 2023

(Memorandum

Only)

Revenues

General and selective taxes - - - - - 4,809,020,548

Income taxes - - - - - 2,177,768,150

Severance taxes - - 1,149,824,573 - - 2,142,085,607

License fees - - - - - 60,653,905

Investment income - - - 69,912,802 9,848,390 261,142,496

Net increa se in fair value of investments - - - (45,156,218) 8,614,941 (36,541,277)

Rents and royalties - - - - - 3,270,512,679

Miscellaneous receipts

-

- - - 23,637,356 70,495,718

Total revenues

-

- 1,149,824,573 24,756,584 42,100,687 12,755,137,826

Expenditure s

Appropriations

Higher education - - - - - 144,982,600

Grants to Public Schools

-

- - - - 39,092,640

Total expenditures

-

- - - - 184,075,240

Excess (deficiency) of revenues

over expenditures

-

- 1,149,824,573 24,756,584 42,100,687 12,571,062,586

Other Financing Sources (Uses)

Transfers in - Sources - 105,148,273 - 722,351,146 - 3,031,093,547

Transfers in - Higher Ed. Universities - - - - - 401,661

Transfers out - Appropriations (12,793,727) (74,396,273) - - - (10,003,869,423)

Transfers out - Other - - (1,149,824,573) - (11,520,191) (5,032,224,554)

Reversions

1,628,822

- - - - 191,718,864

Total other financing sources (uses)

(11,164,905)

30,752,000 (1,149,824,573) 722,351,146 (11,520,191) (11,812,879,905)

Net change in fund balance (11,164,905) 30,752,000 - 747,107,730 30,580,496 758,182,681

Fund balances - beginning of year

11,164,905

565,832,000 - 2,303,331,038 300,245,871 3,230,065,256

Fund balances - end of year

-

596,584,000 - 3,050,438,768 330,826,367 3,988,247,937

SHARE system fund numbers 85400 85200 20730 20950 95200

UNAUDITED*

Administratively

Created Funds

*NM State Investment Council (SIC)

35

State of New Mexico

Component Appropriation Funds

Schedule of Revenues by Source

For the Year Ended June 30, 2023

General

and Selective

Taxes

Income

Taxes

Severance

Taxes

License

Fees