This document is important and

requires your immediate attention

If you are in any doubt about what action to

take,you should seek your own personal advice

immediately from a financial adviser authorised

under the Financial Services and Markets Act

2000 if you are in the UK or, if you are not, from

another appropriately authorised financial adviser.

If you have sold or transferred all your shares

inShell plc (the “Company”), please give this

document and the accompanying documents

tothestockbroker or other agent through whom

the sale or transfer was effected fortransmission

tothepurchaser.

Shell plc

Notice of Annual

General Meeting

Tuesday May 21, 2024 at 10:00 (UK Time)

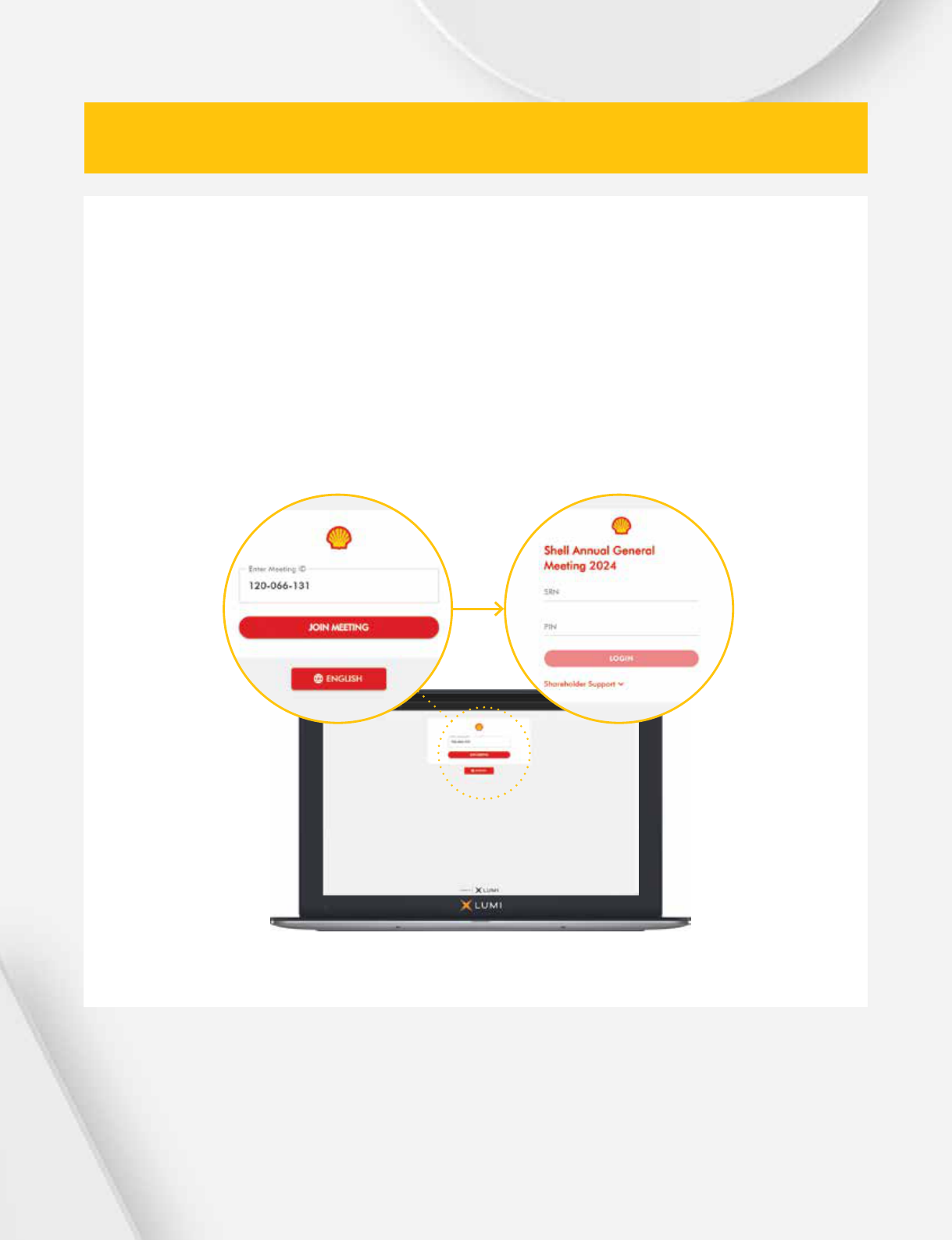

The Shell plc Annual General Meeting will be a

hybridmeeting, held online via the Lumi electronic

meeting platform and at the InterContinental London

– The O2, 1 Waterview Drive, Greenwich Peninsula,

London SE10 0TW, United Kingdom

2 Shell Notice of Annual General Meeting 2024

3

Chair’s Letter

4

Notice of Annual General Meeting

8

Shareholder Resolution

and Supporting Statements

9

Directors’ response

to Shareholder Resolution

11

Explanatory notes on resolutions

14

Directors’ biographies

22

Shareholder notes

25

Attendance arrangements

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this

Notice of Annual General Meeting “Shell”, “Shell Group” and “Group” are sometimes used for convenience

where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our”

are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are

also used where no useful purpose is served by identifying the particular entity or entities.

Also, in this Notice of Annual General Meeting we may refer to Shell’s “Net Carbon Intensity” (NCI), which

includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions

in supplying energy for that production and our customers’ carbon emissions associated with their use of the

energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of

energy products produced by others which Shell purchases for resale. Shell only controls its own emissions.

Theuse of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to

suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every

year. They reflect the current economic environment and what we can reasonably expect to see over the next

ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However,

Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our

planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans

to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk

that Shell may not meet this target.

The contents of any websites referred to in this document do not form part of this document.

Documents incorporated by reference

The Shell Energy Transition Strategy 2024 which was published on March 14, 2024 by way of regulatory

announcement (available at shell.com/investors/news-and-filings/uk-regulatory-announcements.html)

shall be deemed to be incorporated in, and form part of, this Notice of Meeting.

Availability of documents

The Company’s Annual Report and Accounts and the Form 20-F for the year ended December 31, 2023 can

be foundat shell.com/annualreport. The 2024 Notice of Annual General Meeting can also be found at

shell.com/agm. The Shell Energy Transition Strategy 2024 can also be found at shell.com/agm.

If you would like to obtain, free of charge, a paper copy of any of these documents, please contact one

ofthefollowing:

United Kingdom +44 (0)800 169 1679

USA +1 888 301 0504

E-communication

If you are a registered shareholder and hold your shares in your own name, or you hold your shares in the

Shell Corporate Nominee, you can choose to view shareholder communications (for example, the Company’s

Annual Report) by means of our website instead of receiving paper communications. If you opt for website

communications and provide us with your email address, by registering online at shareview.co.uk you will be

sent a notification by email whenever such shareholder communications are added to our website, orinthe

absence of an email address you will be sent a notification by post. Shareholders who participate inthe

meeting electronically are able to access documents electronically that they cannot inspect in person. Ifyou

choose to view shareholder communications by means of our website, you may change your mind at anytime

or obtain, free of charge, acopy of the communication in paper form, by contacting our Registrar atthe

address below.

Equiniti

Aspect House

Spencer Road

Lancing

West Sussex BN99 6DA

United Kingdom

+44 (0)800 169 1679 (UK)

Shell plc

Registered in England and Wales, Company number 04366849

Registered office: Shell Centre, London, SE1 7NA, United Kingdom

Contents

Design and production: Friend

friendstudio.com

Print: Toppan Merrill

Reports are available in

all inclusive formats at

Shell.com/annual-publications

Reporting for all

3Shell Notice of Annual General Meeting 2024

Dear Shareholder,

I am pleased to invite you to the Company’s

Annual General Meeting (“AGM”) which

willbea hybrid meeting, held online via the

Lumielectronic meeting platform, and at the

InterContinental London – The O2, 1 Waterview

Drive, Greenwich Peninsula, London SE10 0TW,

United Kingdom on Tuesday May 21, 2024.

Our hybrid AGM provides three ways in which

shareholders can follow the proceedings: i)

attending and participating in person; ii)

attending and participating in the webcast

byregistering through an electronic platform

(“digitally attending”); or iii) simply watching

thewebcast. Details of how to do each of

theseoptions are provided in this document

onpages 22 to 27.

We strongly encourage you to register for the

“Keep up to date with Shell” section of our

website at shell.com/news-and-insights/

newsroom/email-alerts to receive AGM

information including any changes to the

AGMformat. As in previous years, we strongly

encourage our shareholders to submit their proxy

voting instructions in advance of the meeting.

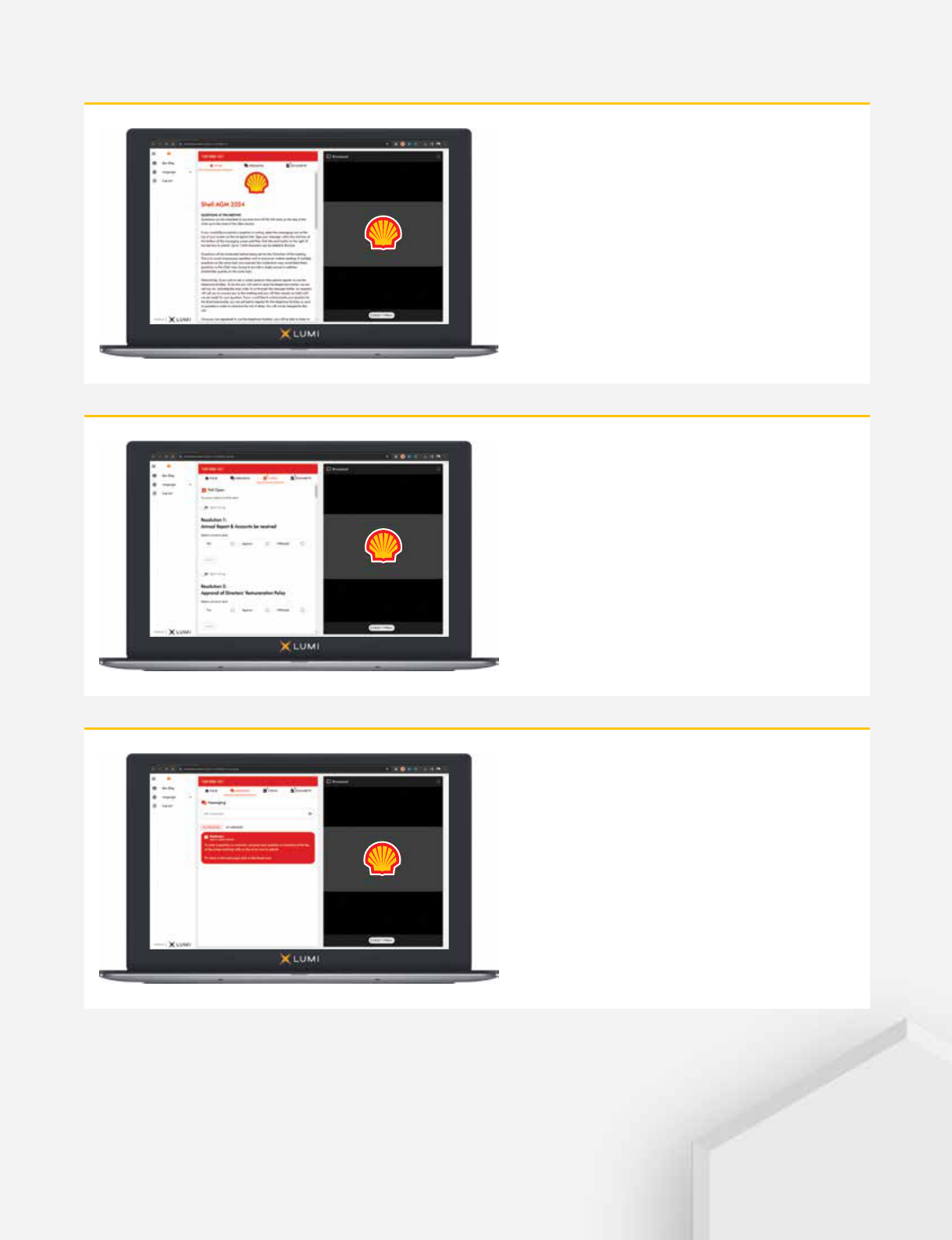

The primary focus of the AGM will be on the

formal business set out in the Notice of Meeting.

However, to facilitate the engagement we value

with our shareholders, the meeting will include

aQuestion and Answer session, as explained

inthis Notice.

Question and Answer session

Our AGM provides an opportunity for

shareholders to ask questions about the

businessset out in this Notice.

The AGM is also an opportunity for the Board

toengage in dialogue with shareholders. Not

only will the Board update shareholders on the

business model and financial performance of the

Company, but shareholders can share their views

and opinions. In recent years, we have sadly

seen some attendees at the meeting whose

methods of engagement were disruptive and,

attimes, unsafe. Actions of this kind will merely

serve tolimit the Board's engagement and

dialogue at the meeting as the Board will always

prioritise the safety of those in attendance.

Therefore, behaviour that may interfere with

anyone’s security or safety or the good order

ofthe meeting (whether physical, verbal or

otherwise) will not be tolerated. Anyone who

does not comply with what the Chair considers

to be the good order of the meeting may be

removed from the meeting without warning.

As Chair of the AGM, I will endeavour to

ensurethat discussions remain relevant and

thatasmany shareholders as possible have

theopportunity to speak. The Question and

Answer session during the AGM will allow both

shareholders attending physically and digitally

an opportunity to pose questions to your Board.

Business of the AGM

The business to be conducted at the AGM is

setout in this Notice with explanatory notes

concerning each of the resolutions. Resolutions

1to 21 represent business which is mainly of a

routine nature for a listed company, and your

Board recommends that you vote in favour

ofthem.

In Resolution 22, the Board is submitting

Shell’sown climate-related resolution to

shareholders foran advisory vote, requesting

that shareholders support Shell’s Energy

Transition Strategy 2024 and vote in favour

ofResolution 22 for the reasons set out on

page 6. Our full Energy Transition Strategy

2024is available at shell.com/agm.

Wehave also received a shareholder resolution

(Resolution 23) pursuant to Section 338 of

theCompanies Act 2006, and your Board

recommends that you vote against this

resolution for the reasons setouton

pages9to10.

The AGM will be conducted in English.

Directors

In line with the UK Corporate Governance Code

(the “Code”), all Directors will retire at the 2024

AGM and seek reappointment by shareholders.

I believe that the Director reappointments

proposed in Resolutions 3 to 14 are in the best

interests of the Company. The biographical

details of each Director are given on pages 14

to19. Finally, an overview of the diversity, skills

and experience represented on the Board is set

out on page 21. I hope you will vote in favour

ofthe Director re-appointment resolutions.

Chair’s letter

Voting

All resolutions for consideration at the AGM

willbe decided on a poll rather than a show

ofhands. This means that a shareholder has

onevote for every share held. Regardless

ofwhether you simply watch the webcast

or digitally attend, we strongly encourage

you to vote your shares ahead of the

meeting through the medium attributable

to the way that you hold your shares.

Yours faithfully,

Sir Andrew Mackenzie

Chair

March 13, 2024

For the latest AGM news

Please register to receive AGM information

in the “Keep up to date with Shell”

sectionof our website at shell.com/

news-and-insights/newsroom/email-alerts

where we will alsonotify shareholders

offuture events in2024.

AGM webcast

Our webcast will be broadcast live at

10:00 (UK time), 11:00 (Dutch time) on

Tuesday May 21, 2024 – the day of the

AGM. Shareholders who wish to simply

watch the webcast should log on to

shell.com/agm/webcast and follow the

online instructions. Shareholders that want

to vote or ask questions at the meeting

should access the digital meeting.

Details of each option can be found on

pages 22 to 27.

4 Shell Notice of Annual General Meeting 2024

Notice is hereby given that the Annual General

Meeting (“AGM“) of Shell plc (the “Company”)

is currently scheduled to be held at the

InterContinental London – The O2, 1 Waterview

Drive, Greenwich Peninsula, London SE10 0TW,

United Kingdom at 10:00 (UK time), 11:00

(Dutch time) on Tuesday May 21, 2024, for the

purpose of considering the following business.

At the time of publication of this Notice, it is

anticipated that the AGM will proceed as a

hybrid meeting. This means that shareholders

willbe able to join and participate in the

meetingin person or by attending and

participating in the digital meeting (“digitally

attending”). All references to attendance herein

mean both digital and in person attendance.

Resolutions numbered 1 to 17, 21 and 22 are

being proposed as ordinary resolutions and

those numbered 18 to 20 and 23 are being

proposed as special resolutions. For ordinary

resolutions to be passed, more than half of the

votes cast must be in favour of the resolution,

while in the case of special resolutions at least

three-quarters of the votes cast must be in favour.

Resolution 1

That the Company’s annual accounts for the

financial year ended December 31, 2023,

together with the Directors’ reports and the

Auditor’s report on those accounts, be received.

Resolution 2

That the Directors’ Remuneration Report,

excluding the Directors’ Remuneration Policy,

setout on pages 191 to 210 of the Directors’

Remuneration Report, for the year ended

December 31, 2023, be approved.

Resolution 3

That Dick Boer be reappointed

as a Director ofthe Company.

Resolution 4

That Neil Carson be reappointed

as a Director ofthe Company.

Resolution 5

That Ann Godbehere be reappointed

as a Director of the Company.

Resolution 6

That Sinead Gorman be reappointed

as a Director of the Company.

Resolution 7

That Jane Holl Lute be reappointed

as a Director of the Company.

Resolution 8

That Catherine Hughes be reappointed

as a Director of the Company.

Resolution 9

That Sir Andrew Mackenzie be reappointed

as a Director of the Company.

Resolution 10

That Sir Charles Roxburgh be reappointed

as a Director of the Company.

Resolution 11

That Wael Sawan be reappointed

as a Director of the Company.

Resolution 12

That Abraham (Bram) Schot be reappointed

as a Director of the Company.

Resolution 13

That Leena Srivastava be reappointed

as a Director of the Company.

Resolution 14

That Cyrus Taraporevala be reappointed

as a Director of the Company.

Resolution 15

That Ernst & Young LLP be reappointed as

Auditor of the Company to hold office until the

conclusion of the next AGM of the Company.

Resolution 16

That the Audit and Risk Committee be authorised

to determine the remuneration of the Auditor for

2024 on behalf of the Board.

Resolution 17

That the Board be generally and unconditionally

authorised, in substitution for all subsisting

authorities, to allot shares in the Company, and

to grant rights to subscribe for or to convert any

security into shares in the Company, up to an

aggregate nominal amount of €150.31 million,

and to list such shares or rights on any stock

exchange, such authorities to apply until the

earlier of the close of business on August 20,

2025, and the end of the AGM to be held in

2025 (unless previously renewed, revoked or

varied by the Company in a general meeting)

but, in each case, during this period, the

Company may make offers and enter into

agreements which would, or might, require

shares to be allotted or rights to subscribe for

orto convert securities into shares to be granted

after the authority ends and the Board may

allotshares or grant rights to subscribe for or to

convert securities into shares under any such offer

or agreement as if the authority had not ended.

Resolution 18

That if Resolution 17 is passed, the Board be

given power to allot equity securities (as defined

in the Companies Act 2006) for cash under the

authority given by that resolution and/or to

sellordinary shares held by the Company as

treasury shares for cash as if Section 561 of

theCompanies Act 2006 did not apply to any

suchallotment or sale, such power to be limited:

(A) to the allotment of equity securities and

saleof treasury shares for cash in connection

with an offer of, or invitation to apply for,

equitysecurities:

(i) to ordinary shareholders in proportion

(asnearly as may be practicable) to their

existingholdings; and

(ii) to holders of other equity securities, as

required by the rights of those securities or,

astheBoard otherwise considers necessary,

and so that the Board may impose any limits or

restrictions and make any arrangements which it

considers necessary or appropriate to deal with

treasury shares, fractional entitlements, record

dates, or legal or practical problems arising in

any overseas territory, the requirements of any

regulatory body or stock exchange or any

othermatter whatsoever; and

(B) to the allotment of equity securities or sale of

treasury shares (otherwise than under paragraph

(A) above) up to a nominal amount of

€22.55 million,

such power to apply until the earlier of the close

of business on August 20, 2025 and the end of

the AGM to be held in 2025 but, in each case,

prior to its expiry, the Company may make offers,

and enter into agreements, which would, or

might, require equity securities to be allotted

(and treasury shares to be sold) after the power

expires and the Board may allot equity securities

(and sell treasury shares) under any such offer

oragreement as if the power had not expired.

Notice of Annual General Meeting

5Shell Notice of Annual General Meeting 2024

Resolution 19

That the Company be authorised for the

purposes of Section 701 of the Companies Act

2006 to make one or more market purchases

(asdefined in Section 693(4) of the Companies

Act 2006) of its ordinary shares of €0.07 each

(“ordinary shares”), such authority to be limited:

(A) to a maximum number of 644.2 million

ordinary shares less the number of ordinary

shares purchased or committed to be purchased

pursuant to the authority under Resolution 20;

(B) by the condition that the minimum price

which may be paid for an ordinary share is

€0.07 and the maximum price which may

bepaid for an ordinary share is the higher of:

(i) an amount equal to 5% above the average

market value of an ordinary share for the five

business days immediately preceding the day

onwhich that ordinary share is contracted to

bepurchased; and

(ii) the higher of the price of the last independent

trade and the highest current independent bid in

respect of ordinary shares on the trading venues

where the purchase is carried out, in each case,

exclusive of expenses,

such authority to apply until the earlier of the

close of business on August 20, 2025, and

theend of the AGM to be held in 2025 but

ineach case so that the Company may enter

intoacontract during this period to purchase

ordinary shares which will or may be completed

or executed wholly or partly after the authority

ends and the Company may purchase ordinary

shares pursuant to any such contract as if the

authority had not ended.

Resolution 20

That, for the purposes of Section 694 of the

Companies Act 2006, the terms of the buyback

contracts proposed to be entered into (in the

form produced to the meeting) (“buyback

contracts”) for off-market purchases (as defined

in Section 693(2) of the Companies Act 2006)

by the Company of its ordinary shares of €0.07

each (“ordinary shares”) be and are approved,

and the Company be and is authorised to

purchase ordinary shares pursuant to any

suchbuyback contract, provided that such

authority be limited:

(A) to a maximum number of 644.2 million

ordinary shares less the number of ordinary

sharespurchased or committed to be purchased

pursuant to the authority granted at Resolution 19;

(B) by the condition that the minimum price

which may be paid for an ordinary share is

€0.07 and the maximum price which may

bepaid for an ordinary share is the higher of:

(i) an amount equal to 5% above the average

market value of an ordinary share for the five

business days immediately preceding the day

onwhich that ordinary share is contracted to

bepurchased; and

(ii) the higher of the price of the last independent

trade and the highest current independent bid in

respect of ordinary shares on the trading venues

where the purchase is carried out, in each case,

exclusive of expenses,

such authority to apply until the earlier of the

close of business on August 20, 2025, and the

end of the AGM to be held in 2025 but in each

case so that the Company may enter into a

buyback contract to purchase ordinary shares

which will or may be completed or executed

wholly or partly after the authority ends and

theCompany may purchase ordinary shares

pursuant to any such buyback contract as if

theauthority had not ended.

Resolution 21

That, in accordance with Part 14 of the

Companies Act 2006 and in substitution for

anyprevious authorities given to the Company

(and its subsidiaries), the Company (and all

companies that are subsidiaries of the Company

at any time during the period for which this

resolution has effect) be authorised to:

(A) make political donations to political

partiesor independent election candidates

notexceeding £100,000 in total for all such

companies taken together;

(B) make political donations to political

organisations other than political parties

notexceeding £100,000 in total for all

suchcompanies taken together; and

(C) incur political expenditure not exceeding

£100,000 in total for all such companies

takentogether,

in each case, as such terms are defined in

theCompanies Act 2006. This authority shall

continue for the period ending on the conclusion

of the Company’s AGM in 2025 or, if earlier,

close of business on August 20, 2025. For the

purposes of this Resolution, the authorised sum

may comprise sums in different currencies that

shall be converted at such rate as the Directors

ofthe Company may in their absolute discretion

determine to be appropriate.

Resolution 22

Shell’s Energy Transition Strategy

2024 resolution

That Shell’s energy transition update

asdisclosedin the Company’s Annual Report

and Accounts for the year-ended December 31,

2023, and Shell’s Energy Transition Strategy

2024, which are published on the Shell website

(shell.com/annualreport and shell.com/agm,

respectively), be approved. Seepages6 to 7

foradditional information.

Resolution 23

Shareholderresolution

The Company has received notice pursuant

tothe Companies Act 2006 of the intention

tomove the resolution set forth on page 8 and

incorporated herein by way of reference at the

Company’s 2024 AGM. The resolution has been

requisitioned by a group of shareholders and

should be read together with their statement in

support of their proposed resolution set forth

onpage 8.

Your Directors consider that Resolution 23

is not in the best interests of the Company

and its shareholders as a whole and

unanimously recommend that you vote

against Resolution 23 for thereasons set

out on pages 9 to 10.

By order of the Board

Caroline J.M. Omloo

Company Secretary

March 13, 2024

This Notice of Meeting should be read and

construed in conjunction with any amendment

orsupplement hereto and any documents

incorporated herein by reference (see

“Documents incorporated by reference”

onpage2). Other than in relation to

thedocuments which are deemed to be

incorporated by reference, the information

onwebsites to which this Notice of Meeting

refers does not form part of this Notice.

Notice of Annual General Meeting continued

6 Shell Notice of Annual General Meeting 2024

Shell's Energy Transition Strategy 2024 – Resolution 22

Resolution 22 asks shareholders to approve

Shell’s energy transition update, as disclosed

inthe Company’s Annual Report and Accounts

for the year-ended December 31, 2023, AND

Shell’s Energy Transition Strategy 2024,

whichare published on the Shell website

(shell.com/annualreport and shell.com/agm,

respectively).

This is an opportunity to take stock of the

Company’s progress, to reflect on what Shell

has learned, and to look forward to Shell’s

target to become a net-zero emissions energy

business by 2050. Shell believes this target

supports the more ambitious goal of the Paris

Agreement, to limit the rise in the global

average temperature to 1.5°C above

pre-industrial levels.

At its Capital Markets Day in June 2023,

Shelloutlined how its Powering Progress

strategy delivers more value with less emissions,

emphasising the “more value” part of its

strategy. In this energy transition update,

Shellis focusing on how the same strategy

delivers “less emissions”.

Shell’s energy transition plans cover all its

businesses. In Integrated Gas, Shell is growing

its world-leading LNG business with lower

carbon intensity. In Upstream, it is reducing

emissions from oil and gas production.

InDownstream, Renewables and Energy

Solutions, Shell is growing sales of low-carbon

products and solutions such as biofuels,

charging for electric vehicles and renewable

power, while investing in hydrogen and other

fuels of the future.

The Company’s focus on performance,

discipline and simplification is driving clear

choices about where it can create the most

value for investors and customers through the

energy transition. Shell’s ability to raise and

invest capital depends on delivering strong

returns to shareholders, shaping the role that

Shell can play on the journey to net zero. The

Company believes this focus makes it more,

notless, likely that it will achieve its climate

targets and ambitions.

Progress towards targets and

ambitions

As Shell works towards net zero, it is reducing

emissions from its operations and energy

products while becoming an increasingly

successful organisation.

At its Capital Markets Day, the Company said

it would deliver more value with less emissions

and it has made good progress in the first year

under its new Chief Executive Officer Wael

Sawan. By the end of 2023, for example,

Shellhad achieved more than 60% of its

targetto halve Scope 1 and 2 emissions from

itsoperations by 2030, compared with 2016.

Shell achieved its short-term target to reduce

the net carbon intensity of the energy products

it sells, with a 6.3% reduction against its target

of 6-8% compared with 2016. Shell also

continues to be one of the leaders in reducing

methane emissions. In 2023, Shell continued

tokeep its methane emissions intensity well

below 0.2%.

Shell wants to lead in the decarbonisation of

transport using the strength of its brand, deep

customer relationships and global reach. As the

energy transition progresses, Shell expects to

sell more low-carbon products and solutions,

and less oil products including petrol and

diesel. To measure its progress, Shell has set

anew ambition to reduce customer emissions

from the use of Shell’s oil products by 15-20%

by 2030 compared with 2021 (Scope 3,

Category 11). That is more than 40%

comparedwith 2016. [A]

In line with our shift to prioritising value over

volume in power, we are concentrating on

select markets and segments. One example is

our focus on commercial customers more than

retail customers. Given this focus on value, we

expect growth in total power sales to 2030 will

be lower than previously planned. This has led

to an update to our net carbon intensity target.

We are now targeting a 15-20% reduction by

2030 in the net carbon intensity of the energy

products we sell, compared with 2016, against

our previous target of a 20% reduction.

Acknowledging uncertainty in the pace of

change in the energy transition, we have also

chosen to retire our 2035 target of a 45%

reduction in net carbon intensity.

Towards net zero

In total, Shell invested $5.6 billion in low-

carbon solutions in 2023, which was 23%of

itscapital spending. Shell is investing $10-15

billion in low-carbon energy solutions between

2023 and the end of 2025, making Shell a

significant investor in the energy transition.

With its focused approach, the Company

believes itsinvestments will have an important

impact, allowing Shell to develop low-carbon

solutions at increasingly affordable prices for

itscustomers.

Resolutions

This year, we are asking shareholders to vote

atour Annual General Meeting (AGM) on

Shell’s energy transition update. As was the

case for Shell’s Energy Transition Strategy put

to shareholders vote in 2021 (ETS21), as well

asshareholder votes on progress against

ETS21 atAGMs in 2022 and 2023, this

voteispurely advisory, and not binding on

ourshareholders. The legal responsibility for

approving or objecting to Shell’s strategy lies

with the Boardand Executive Committee.

The Board considers another resolution,

proposed by Follow This (Resolution 23),

tobeagainst shareholders’ financial interests

and believes it would not help to mitigate

global warming.

Resolution 23 is therefore also not in line with

the Company’s strategy, which is intended to

promote the success of the Company and

accelerate the energy transition.

Conclusion

The Company believes its target to become

anet-zero emissions energy business by

2050is in line with the 1.5°C goal of the

ParisAgreement. Your Directors believe the

Company’s strategy will transform Shell into

anet-zero emissions energy business, creating

value for its shareholders, customers and

widersociety.

The Board unanimously recommends that you

vote in favour of Resolution 22 in support of

Shell’s energy transition update described in

the Company’s Annual Report and Accounts

for the year-ended December 31, 2023, and

Shell’s Energy Transition Strategy 2024.

[A] Customer emissions from the use of our oil products

(Scope 3, Category 11) were 517 million tonnes carbon

dioxide equivalent (CO

2

e) in 2023, 569 million tonnes

CO

2

e in 2021 and 819 million tonnes CO

2

e in 2016.

Ofthe 40% reduction by 2030, around 8 percentage

points are related to volumes associated with additional

contracts being classified as held for trading purposes,

impacting reported volumes from 2020 onwards.

7Shell Notice of Annual General Meeting 2024

Shell's Energy Transition Strategy 2024 – Resolution 22 continued

Engagement

Shell recognises and values the importance

ofshareholder engagement when considering

itsenergy transition progress and has included

information on these engagements within

theCompany’s Annual Report and Accounts

for the year ended December 31, 2023,

asrequired by the UK Corporate

GovernanceCode.

The Board is grateful for the time and

contribution ofall those stakeholders who

provided feedback and for the overall indications

of support for Shell’s strategy. Following the

2023 AGM, we engaged with our largest

shareholders offering further opportunities to

discuss the progress made in implementing

Shell’s energy transition strategy, and to

understand the reasons behind various voting

decisions. The Chair of the Board subsequently

hadan opportunity to engage directly with our

large institutional shareholders during his investor

roadshow in September 2023 and will do so

again in April 2024. The 2023 advisory vote on

our progress created more informed dialogues

with ourinstitutional shareholders. The dialogue

highlighted that our large shareholders that did

notvote in linewith the Board recommendation

onthe Shell Energy Transition Progress

Resolution and the 2023 Shareholder Resolution

were predominately focused on Shell’s energy

transition strategy andnot the 2022 progress,

which is what the Shellproposed Resolution

related to. Some shareholders outlined societal

pressure influencing media coverage and

expectations from beneficial owners as reasons

for not aligning with the Board recommendation.

Others raised questions related tomedium

termtargets.

Accountability

Setting the Company strategy is the

responsibility of the Board, and the advisory

vote on Shell’s Energy Transition Strategy

2024(Resolution 22) does notchange that

fundamental principle. As stated in 2021, when

the Company published its Energy Transition

Strategy, voting on the resolutions that the

Company puts for an advisory vote will not be

binding on shareholders – shareholders are not

being asked to take responsibility for approving

orobjecting to Shell’s strategy, since that legal

responsibility lies with the Board and the

ExecutiveCommittee.

The purpose of the vote on Resolution 22 is to

provide shareholders with a vehicle to express

their views on whether the Company’s strategy,

and its strategic targets, and its reasonableness

in the current environment.

The Directors are aware of the varying

stakeholder views, and multiple motives

whenvoting on such a matter. The Company

therefore wishes to clarify that if Resolution 22

is not passed, or receives notable votes against

(more than 20%), the Company will engage

with, and provide updates to, investors as

prescribed under provision 4 of the2018

UKCorporate Governance Code.

Any future shareholder engagements will take

into account the voting outcome for Resolution

22 at the 2024 AGM.

8 Shell Notice of Annual General Meeting 2024

Shareholder Resolution and Supporting Statement – Resolution 23

SHAREHOLDER RESOLUTION

Shareholders support the Company, by

anadvisory vote, to align its medium-term

emissions reduction targets covering the

greenhouse gas (GHG) emissions of the use

ofits energy products (Scope 3) with the

goalof the Paris Climate Agreement: to limit

global warming to well below 2°C above

pre-industrial levels and to pursue efforts

tolimit the temperature increase to 1.5°C.

The strategy for achieving these targets is

entirelyup to the board.

You have our support.

SUPPORTING STATEMENT

Introduction

The world has signed the Paris Agreement,

pledging to limit global warming to well below

2°C and to pursue efforts to limit warming

to1.5°C. Failure to do so will have dramatic

effects for society at large, including the global

economy. Greenhouse gas (GHG) emissions

arethe leading driver of global warming. The

Company is a leading contributor to global

GHG emissions.

Paris alignment

Scientific consensus indicates that global

emissions must almost halve this decade

tokeep1.5°C within reach.

The Intergovernmental Panel on Climate Change

(IPCC) stated that “unless there are immediate,

rapid and large-scale reductions in greenhouse

gas emissions, limiting warming to close to 1.5°C

or even 2°C will be beyond reach.”¹

Since the energy sector accounts for the vast

majority of global emissions, it must achieve

large-scale emissions reductions this decade to

reach the goal of the Paris Climate Agreement.

The International Energy Agency (IEA)

underscores the critical role of energy-related

emissions in its Net Zero Roadmap, A Global

Pathway to Keep the 1.5°C Goal in Reach:

“Getting to net zero emissions by 2050 requires

rapid and deep cuts in emissions of both carbon

dioxide (CO₂) and other greenhouse gases

(GHG), particularly methane, by 2030.”²

As a result, for a major player in the energy

sector, Paris alignment implies targets that

significantly contribute to reducing global

emissions by 2030.

The Company’s medium-term targets

are not Paris aligned

Shell’s medium-term targets covering Scope 3

are a decrease of the Net Carbon Intensity

(NCI) of 20% by 2030 and 45% by 2035

(atthe time of filing this resolution), compared

to2016 levels.³

The Climate Action 100+ benchmark states that

the Company’s medium-term GHG emissions

reduction target(s) are not aligned with the

goalof limiting global warming to 1.5°C.⁴

No third-party source indicates that Shell’s

medium-term targets are aligned with a 1.5°C

warming scenario.

Moreover, the Company does not sufficiently

demonstrate how it will reach these targets,

which means it is unclear how the underlying

approach contributes to significant reductions

inglobal emissions this decade.

Risks of misalignment

A lack of Paris-aligned targets poses significant

risks to the Company. These risks include:

Regulation: As countries work to achieve their

commitments under the Paris Agreement, more

stringent regulations should be implemented.

Thisrisks leaving planned oil and gas projects

stranded, which would result in significant losses

to the Company. Uncertainty about the timing

ofthe effects of climate change and shifts in

public sentiment may bring about a disorderly

transition, resulting in abrupt implementation of

regulation, negatively affecting the profitability

offossil fuels and further increasing the risks of

stranded assets.

Loss of market opportunity: As the global energy

market transitions toward a net-zero energy

system, there will be increased demand for

low-carbon energy products. The Company

riskslosing the opportunities that this

demandpresents.

Litigation: Instances of climate litigation

againstoil majors are increasingly sharply.

Asthelegal framework around this becomes

more established and liability more certain,

theCompany is exposed to increasing

financialliability.

Carbon lock-in: By investing recent record

profitsin continued fossil fuel extraction,

theCompany risks locking itself into an

unsustainable business model.

We advise the Company to adopt

Paris-aligned targets

By adopting Paris-aligned targets, the Company

can spur innovation both internally and in the

market as a whole. Furthermore, it sends a signal

to policy makers that will help to advance the

necessary regulation. Paris-aligned targets will

help to protect the Company’s long-term value.

An increasing number of investors are realizing

this, which is why support for this climate

resolution has increased from 2.7% in 2016

to20% in 2023.

A vote for this proposal is warranted by investors

who seek to ensure a long-term future for the

Company and to protect the value of their entire

investment portfolios.

You have our support.

1. IPCC, August 2021: Climate change widespread, rapid, and intensifying (ipcc.ch/2021/08/09/ar6-wg1-20210809-pr/)

2. IEA, September 2023: Net Zero Roadmap: A Global Pathway to Keep the 1.5°C Goal in Reach – 2023 Update (page 108)

(iea.blob.core.windows.net/assets/13dab083-08c3-4dfd-a887-42a3ebe533bc/NetZeroRoadmap_AGlobalPathwaytoKeepthe1.5CGoalinReach-2023Update.pdf)

3. Shell’s strategy: Net Carbon Intensity (NCI) is the Company’s proprietary intensity metric which combines the emissions of its operations and use of its energy products (Scopes 1, 2, and 3)

intoasingle intensity figure in terms of the grams of carbon dioxide equivalent (gCO₂eq) per unit of energy (MJ) sold. (shell.com/energy-and-innovation/the-energy-future/our-climate-target.

html#vanity-aHR0cHM6Ly93d3cuc2hlbGwuY29tL3Bvd2VyaW5nLXByb2dyZXNzL2FjaGlldmluZy1uZXQtemVyby1lbWlzc2lvbnMuaHRtbA)

4. CA100+, 2023: Net Zero Company Benchmark – Shell plc (climateaction100.org/company/royal-dutch-shell/)

9Shell Notice of Annual General Meeting 2024

Your Directors believe that Resolution 23 is

against both good governance and shareholders’

interests, and also has negative consequences for

our customers. The resolution, if approved, would

have a material negative financial impact on the

Company and its ambition to be the investment

case through the energy transition. Your Directors

believe that Resolution 23 will also not mitigate

global warming – it could potentially have the

opposite impact and also negatively impact

energy security.

Despite the statements made in the resolution,

Shell has targets and ambitions that it believes

are in line with the more ambitious goal of the

Paris Agreement to limit global warming this

century to 1.5°C above pre-industrial levels

andit is making good progress towards

achieving these targets and ambitions.

As outlined in Shell’s Articles of Association, a

shareholder resolution is a Special Resolution,

which, if passed, would be binding on the

Company. Resolution 23 states within its text

that it is an “advisory” resolution. This is not

correct. A Special Resolution requires at least

75% of the votes cast to be in favour. If passed,

it would be binding on the Company, and form

part of the Company’s constitution.

Against good governance

A special resolution should provide a company

with a clear course of action. Resolution 23 fails

todo this. It claims to be advisory (which it is not),

it is unclear, generic, and attempts to remove

thesetting of strategic targets from the Board’s

control, thereby creating confusion as to Board

and shareholder accountabilities. When

considering Resolution 23, it is important for

shareholders to carefully read and understand the

supporting statement provided with the Follow

This resolution, as the Board must rely on the

supporting statement if Resolution 23 is passed.

Resolution 23 supposedly calls for new targets

that could conflict with Shell’s Energy Transition

Strategy which is being put to shareholders at

the 2024 AGM. This includes a new ambition

and changes to current targets which Shell

believes reflect feedback received from

stakeholders and support the more ambitious

goal of the Paris Agreement.

Rather than vote for Resolution 23, the Board

instead encourages its shareholders to vote

onShell’s Energy Transition Strategy 2024

(Resolution 22). Resolution 22 is an advisory

vote, as it is put to a shareholder vote by the

Board and is therefore not binding on Shell’s

shareholders. The legal responsibility for

approving or objecting to Shell’s strategy

lieswith the Board and Executive Committee.

Against shareholder interests

Shell believes that its targets and ambitions

toreduce emissions, with the goal of becoming

a net-zero emissions energy business by 2050,

support the more ambitious goal of the Paris

Agreement to limit global warming this century

to 1.5°C above pre-industrial levels.

The Directors do not support Resolution 23 and unanimously recommend that you vote against it.

Directors’ response to Shareholder Resolution 23

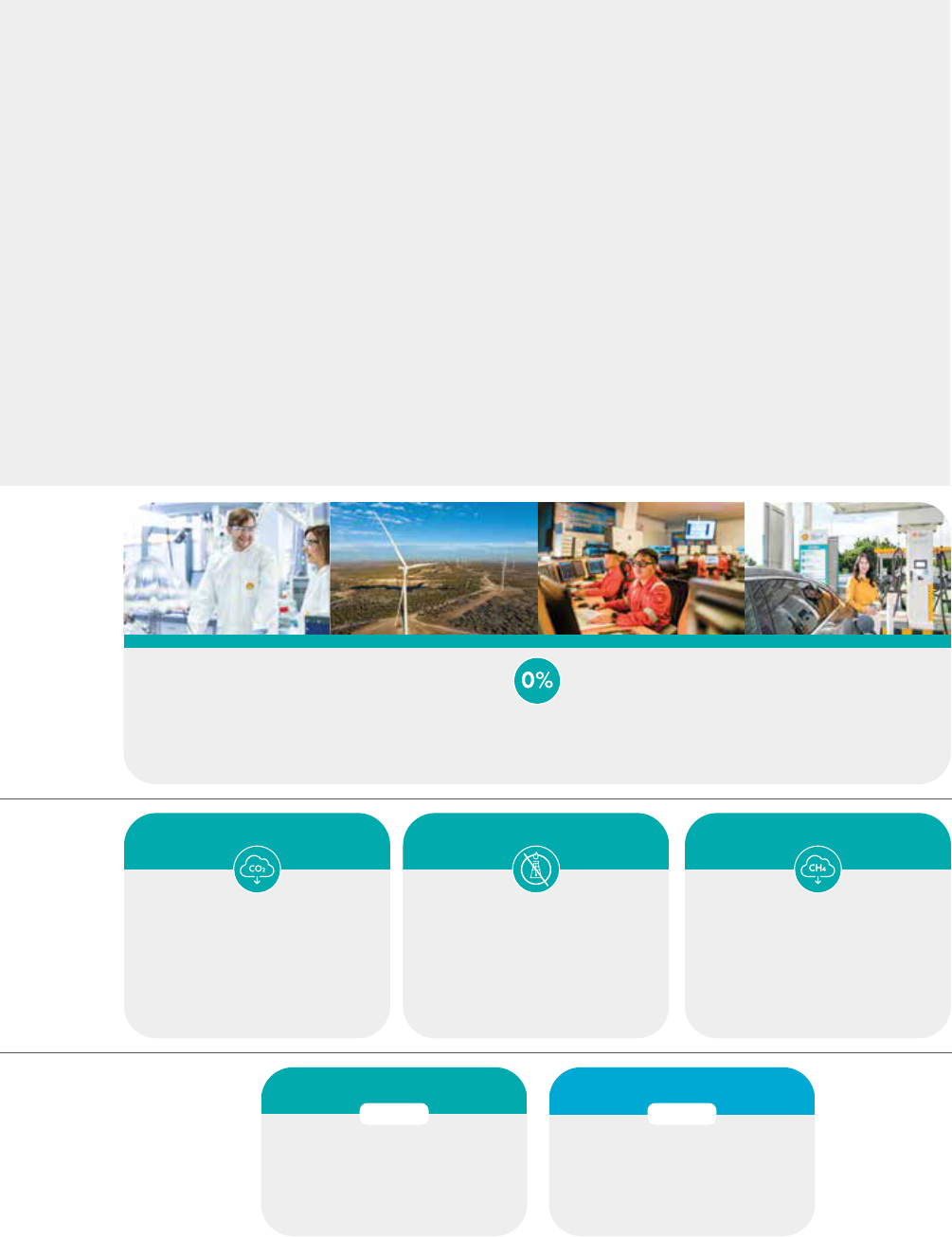

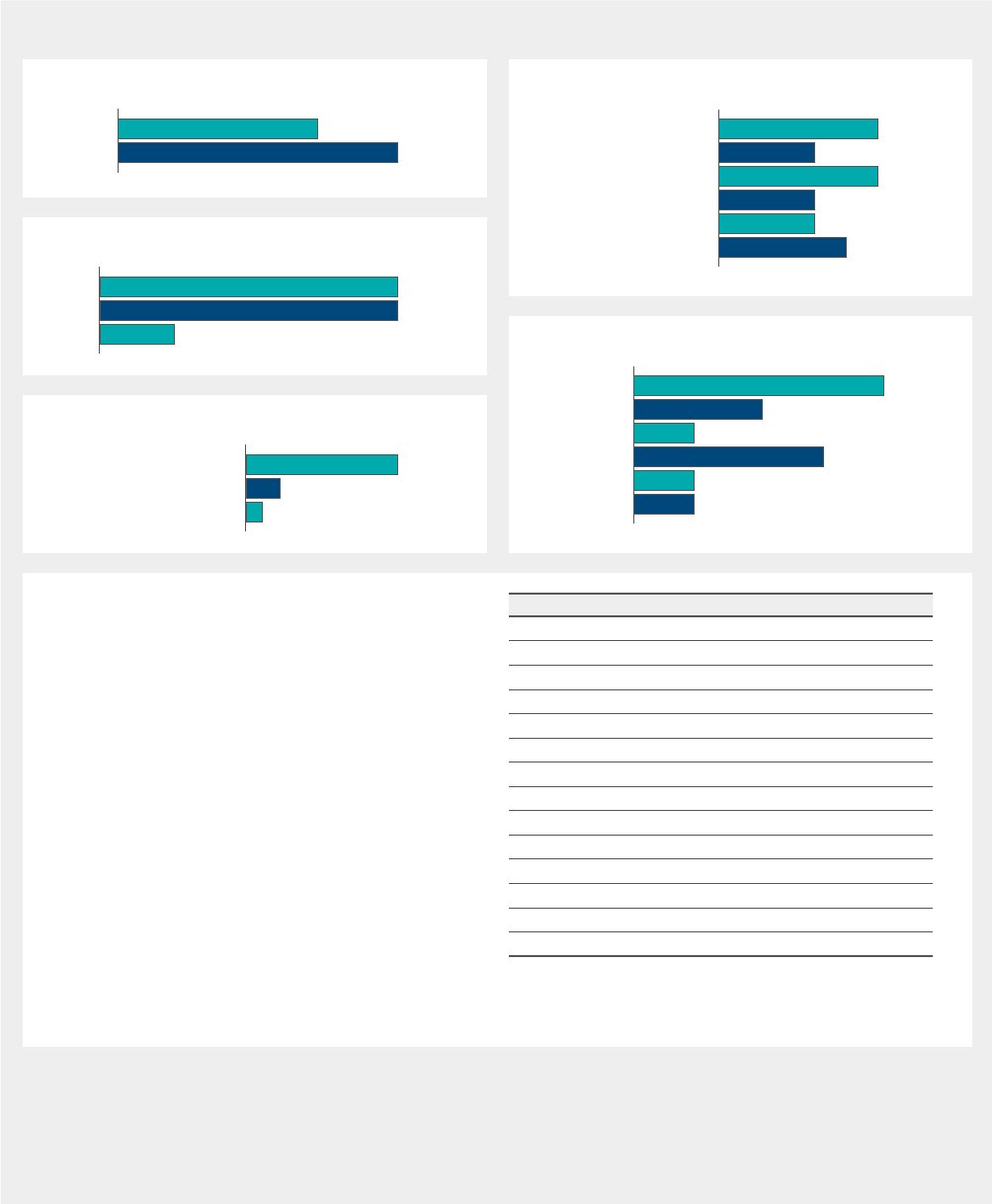

Emissions from

the products we

sell (Scope 3)

Eliminating

routine flaring

from Upstream

operations

by 2025 [B]

Target Target Target

Shell’s

Energy

Transition

2024

targets

and

ambitions

Maintain methane

emissions intensity

below 0.2% and achieve

near-zero methane

emissions by 2030

Net-zero emissions by 2050

(Scopes 1, 2 and 3)

Emissions

from

our own

operations

(Scope 1

and 2)

Halving Scope

1 and 2 emissions

by 2030 [A]

under operational control

(2016 reference year)

AmbitionTarget

Oil products ambition

Reduce customer emissions from the

use of our oil products by 15-20%

by 2030, Scope 3 Category 11 [C]

(2021 reference year)

Net carbon intensity (NCI)

Introducing a range of 15-20%

for our target to reduce

NCI by 2030

(2016 reference year)

NewUpdated

[A] On a net basis.

[B] Subject to completion of the sale of Shell Petroleum Development Company of Nigeria Limited (SPDC).

[C] Customer emissions from the use of our oil products (Scope 3, Category 11) were 517 million tonnes carbon dioxide equivalent (CO

2

e) in 2023 and 569 million tonnes CO

2

e in 2021.

10 Shell Notice of Annual General Meeting 2024

Directors’ response to Shareholder Resolution 23 continuedDirectors’ response to Shareholder Resolution 23 continued

Additional Shell disclosures:

A. 2023 Annual Report: Our journey to net zero starts on page 82, (reports.shell.com/annual-report/2023/_assets/downloads/shell-annual-report-2023.pdf).

B. Energy Transition Strategy 2024, (shell.com/sustainability/our-climate-target/shell-energy-transition-strategy/_jcr_content/root/main/section/promo_copy_copy/links/item0.

stream/1710386815551/26357bbb7c06090d26fe803a7da5f23c637c8a56/shell-energy-transition-strategy-2024.pdf).

C. Climate and Energy Transition Lobbying Report 2022, (reports.shell.com/climate-and-energy-transition-lobbying-report/2022/_assets/downloads/shell-climate-and-energy-transition-lobbying-

report-2022.pdf)

[A] According to our analysis and data from the International Energy Agency.

[B] According to our analysis and data from the International Energy Agency, Overview – Global Methane Tracker 2023 – Analysis – IEA.

[C] Customer emissions from the use of our oil products (Scope 3, Category 11) were 517 million tonnes per annum (mtpa) in 2023, 569 mtpa in 2021 and 819 mtpa in 2016. Of the 40%

reduction by 2030, around 8 percentage points are related to volumes associated with additional contracts being classified as held for trading purposes, impacting reported volumes

from 2020 onwards.

The supporting statement of Resolution 23

suggests a further reduction of the Scope 3

emissions Shell reports. Doing so, without

changing demand and the way in which

customers use energy, would effectively mean

handing over retail and commercial customers

to competitors. This would materially affect

Shell’s financial strength and limits its ability to

generate value for shareholders. Shell is instead

pursuing a global leadership role in electric

vehicle charging and low-carbon fuel solutions

tohelpenable transport customers to

lowertheiremissions.

Negative consequences for

customers

The world needs secure, affordable, and

low-carbon energy. Shell wants to continue

toprovide the energy the world needs today,

while working with customers and governments

to change the way energy is consumed

tomorrow. Supporting our customers as

they decarbonise their businesses and lives

by offering low- and zero-carbon products

and services is at the heart of Shell’s energy

transition strategy.

As an energy user, Shell has a target to reduce

its absolute emissions from its operations

(Scope 1 and 2), by 50% by 2030 (2016

baseline) on a net basis. Shell has delivered

a31% reduction at the end of 2023 (2016

baseline). Global energy-related carbon

emissions increased by around 7% over

thesame period. [A]

Shell has also set a near-zero methane

emissions target by 2030. Shell’s methane

emissions performance was in 2023 estimated

to be >10 times better than the performance

ofthe sector overall [B].

As an energy provider, Shell’s ambition to

reduce customer emissions from the use of

ouroil products by 15-20% by 2030, Scope

3,Category 11 (2021 baseline) equates to

morethan a 40% reduction since 2016 [C].

Incomparison, our analysis using data from

theInternational Energy Agency shows that

absolute emissions from oil products emissions

globally remained flat since 2016. Our

ambition is also in line with the European

Union’s climate goals for transport, among

themost progressive in the world.

In line with our shift to prioritising value over

volume in power, we are concentrating on

select markets and segments. One example is

our focus on commercial customers more than

retail customers. Given this focus on value, we

expect growth in total power sales to 2030 will

be lower than previously planned. This has led

to an update to Shell’s net carbon intensity

(NCI) target. Shell is now targeting a 15-20%

reduction by 2030 in the net carbon intensity

of the energy products we sell, compared

with2016, against its previous target of a

20%reduction.

Shell has achieved a 6.3% NCI reduction

since2016. Our analysis, using data from the

International Energy Agency, shows the net

carbon intensity of the global energy system

fellby around 3% over that same time.

The resolution is not mitigating

global warming

Follow This states that the energy sector

accounts for the vast majority of global

emissions. Shell believes that its targets and

ambitions support the more ambitious goal of

the Paris Agreement to limit global warming this

century to 1.5°C above pre-industrial levels.

Shell believes it plays a positive role in the

transport sector by offering low-carbon energy

alternatives like electric vehicle charging and

biofuels. Shellalso supports LNG as a critical

fuel in the energy transition, as it replaces coal,

supports energy security, and is an intermittent

fuel to renewable power by providing

gridstability when wind and solar power

areunavailable.

Shell is not accountable for customers’ need for

transport and power usage across the world.

Such a representation of accountability delays

the energy transition by being unrealistic about

the role of the supply side of the energy system.

Shell encourages shareholders to engage in

amore meaningful energy transition debate;

one that can stimulate real progress through

collaboration with commercial and private

customers, governments and stakeholders.

Supporting Resolution 23 is more harmful

thanhelpful to the required mitigation of

globalwarming.

Conclusion

Shell has set targets and ambitions that it

believes are in line with the 1.5°C goal of

theParis Agreement and it is making good

progress towards achieving these targets

andambitions. Its strategy supports a

balanced and orderly energy transition, while

accelerating the shift to low- and zero-carbon

energy. Resolution 23, if passed, would weaken

the Company’s ability to deliver its strategy,

would restrict the Company’s role in the energy

transition and is against good governance.

Itcontinues to present an energy transition

narrative that does not recognise

accountability for use of energy. That has,

onbalance, a negative impact on the climate.

THE DIRECTORS DO NOT CONSIDER

RESOLUTION 23 TO BE IN THE BEST

INTERESTS OF THE COMPANY, ITS

SHAREHOLDERS AS A WHOLE, OUR

CUSTOMERS, AND THE CLIMATE.

THE DIRECTORS RECOMMEND

THATYOU VOTE AGAINST

RESOLUTION 23.

11Shell Notice of Annual General Meeting 2024

Note to resolution 1

Annual Report and Accounts

The Board of Directors will present the

Company’s annual accounts for the financial

year ended December 31, 2023, together with

the Directors’ reports and the Auditor’s report

onthose accounts.

Note to resolution 2

Consideration and approval of the

Directors’ Remuneration Report

Resolution 2 is an advisory vote and seeks

approval for the Directors’ Remuneration

Reportfor the year ended December 31, 2023,

excluding the Directors’ Remuneration Policy (the

“Policy”). The Report has been prepared and is

laid before the meeting in accordance with the

Companies Act 2006.

Shareholders approved a resolution at the 2023

AGM in relation to the Policy. The Company must

seek approval for a similar resolution each year

unless the Policy is left unchanged, in which case

shareholder approval need only be sought every

three years. The approved Policy is shown for

information purposes within the Annual Report

on pages 211 to 218.

Note to resolutions 3 to 14

Reappointment of Directors

In line with the Code, all Directors will retire

atthe AGM and seek reappointment by

shareholders. The biographical details of

theDirectors are given on pages 14 to 19.

Pursuant to the Code, all Non-executive Directors

have received performance evaluations and

were considered to be effective in their roles

andto be committed to making available the

appropriate time for Board meetings and other

duties. Please see the summary of the 2023

Board evaluation on page 20. A full overview

ofthe Board and Board Committee evaluation

can be found on page 166 of the Annual Report

for the year ended December 31, 2023.

The Board recommends that you support the

reappointment of each of the Directors standing

for reappointment at the AGM.

Note to resolutions 15 and 16

Reappointment of Auditor and

determination of Auditor’s

remuneration

The Company is required to appoint an Auditor

for each financial year of the Company, to hold

office until the conclusion of the next general

meeting at which accounts are laid before

theCompany. Resolution 15 proposes the

reappointment of Ernst & Young LLP as the

Company’s Auditor and Resolution 16 seeks

authority for the Audit and Risk Committee

todetermine their remuneration on behalf

oftheBoard.

Note to resolution 17

Authority to allot shares

This resolution would give the Directors the

authority to allot ordinary shares or grant rights

to subscribe for or to convert any securities into

ordinary shares up to an aggregate nominal

amount equal to €150.31 million (representing

2,147,340,498 ordinary shares of €0.07 each).

This amount represents approximately one-third

of the issued ordinary share capital of the

Company as at March 13, 2024, the latest

practicable date prior to publication of this

Notice. The Company does not hold any

sharesin treasury as at the date of this Notice.

This authority complies with the guidelines

issuedby institutional investors.

The Directors’ authority under this resolution will

expire at the earlier of either the close of business

on August 20, 2025, or the end of the AGM of

the Company to be held in 2025. The Directors

have no present intention to exercise the

authority sought under this resolution, however

the full authority gives the Directors flexibility

totake advantage of business opportunities

asthey arise.

Note to resolution 18

Disapplication of pre-emption rights

This resolution will be proposed as a special

resolution, which requires at least three-quarters

of the votes cast to be in favour. It would give the

Directors the authority to allot ordinary shares

(orsell any ordinary shares which the Company

elects to hold in treasury) for cash without first

offering them to existing shareholders in

proportion to their existing shareholdings.

This authority would be, similar to previous years,

limited to allotments or sales in connection with

pre-emptive offers to ordinary shareholders and

offers to holders of other equity securities, if

required by the rights of those securities or as

theBoard otherwise considers necessary, or

otherwise up to an aggregate nominal amount

of €22.55 million (representing 322 million

ordinary shares of €0.07 each). This aggregate

nominal amount represents approximately 5% of

the issued ordinary share capital of the Company

as at March 13, 2024, the latest practicable

date prior to publication of this Notice.

The authority will expire at the earlier of the close

of business on August 20, 2025, and the end of

the AGM of the Company to be held in 2025.

The Directors have no immediate plans to make

use of this authority. The Directors confirm that

should they utilise the authority in Resolution 18,

they intend to follow the shareholder protections

set out in Section 2B of the Pre-Emption

Group’sStatement of Principles on Disapplying

Pre-Emption Rights issued in November 2022,

tothe extent reasonably practicable and

relevant (the resolution does not provide

forfollow-on offers).

Note to resolutions 19 and 20

Authority to make on and off market

purchases of ordinary shares

Resolutions 19 and 20 would allow the

Companyto buy back its own ordinary shares

via methods permitted by the Companies

Act2006. Eachresolution will be proposed

asaspecial resolution, which requires at least

three-quarters of the votes cast to be in favour.

Resolution 19 would allow the Company to buy

back its ordinary shares by way of on-market

purchases on a recognised investment exchange

pursuant to section 701 of the Companies Act

2006. However, as Euronext Amsterdam, CBOE

Europe DXE and Turquoise Europe are not

recognised investment exchanges for the

purposes of Section 693(2) of the Companies

Act 2006, buybacks conducted on these

exchanges do not qualify as “on-market”

purchases. Therefore, approval of off-market

purchases is sought under Resolution 20

toenable share buybacks of shares on

theseexchanges.

The Directors regard the ability to repurchase

issued shares in suitable circumstances as an

important part of the financial management

ofthe Company, and therefore consider it

tobedesirable to have the authority to make

purchases by way of on market purchases under

Resolution 19 and / or off-market purchases

under Resolution 20 (the latter of which, as

described above, only covers open-market

buybacks of ordinary shares on Euronext

Amsterdam, CBOE Europe DXE and Turquoise

Europe) to have increased flexibility in

conducting buybacks of ordinary shares.

Forfurther information on the Company’s

approach to returning capital to its

shareholders,including details of distributions

made during 2023, please refer to page 36

ofthe Annual Report for the year

endedDecember 31, 2023.

The Directors will only repurchase ordinary

shares under the authority sought under

Resolutions 19 or 20 when, in the light of

prevailing market conditions, they consider

thatsuch purchases would result in an increase

inearnings per share and would be in the

bestinterests of the shareholders generally.

There can be no certainty as to whether the

Company will repurchase any of its ordinary

shares, or as to the amount of any such buybacks

or the prices at which such buybacks may be

made. The Board is making no recommendation

as to whether shareholders should sell their

ordinary shares in the Company. The Company

purchased 259.1 million ordinary shares in the

period from the last AGM to March 13, 2024,

under the existing authority to make market

purchase of ordinary shares.

Explanatory notes on resolutions

12 Shell Notice of Annual General Meeting 2024

Ordinary shares purchased by the Company

pursuant to the authority sought under

Resolutions 19 and 20 will either be cancelled or

held in treasury. Treasury shares are shares in the

Company which are owned by the Company

itself. The Company currently has no ordinary

shares in treasury.

The Company has no warrants in issue in relation

to its ordinary shares and no options to subscribe

for its ordinary shares outstanding.

Authority to make on-market

purchases of ordinary shares

Under Resolution 19, authority is sought to

allowthe Company to buy back its own ordinary

shares by way of market purchases (as such term

is defined in Section 693(4) of the Companies

Act 2006), in accordance with specific

procedures set out in the Companies Act 2006.

Authority is sought for the Company to purchase

up to 10% of its issued ordinary shares (excluding

any treasury shares), less any ordinary shares

repurchased under any authority granted under

Resolution 20, renewing the authority granted

byshareholders at previous AGMs.

The minimum price, exclusive of expenses, which

may be paid for an ordinary share is €0.07. The

maximum price, exclusive of expenses, which

may be paid for an ordinary share is the higher

of: (i) an amount equal to 5% above the average

market value for an ordinary share for the five

business days immediately preceding the date

ofthe purchase; and (ii) the higher of the price

ofthe last independent trade and the highest

current independent bid in relation to ordinary

shares on the trading venues where the purchase

is carried out.

The authority will expire at the earlier of the close

of business on August 20, 2025, and the end of

the AGM of the Company to be held in 2025.

Authority to make off-market

purchases of ordinary shares

Under Resolution 20, authority is sought to

allowthe Company to buy back its own

ordinaryshares by way of off-market purchases

(as such term is defined in section 693(2) of the

Companies Act 2006) on Euronext Amsterdam,

CBOE Europe DXE and Turquoise Europe. This

authority is necessary in addition to that under

Resolution 19 because, for the purposes of the

Companies Act 2006, any repurchase of

ordinary shares through Euronext Amsterdam,

CBOE Europe DXE and Turquoise Europe

constitutes an “off-market” transaction. As

such,these buybacks may only be made

pursuant to a form of buyback contract (a

“buyback contract”), the terms of which have

been approved by shareholders in accordance

with Section 694 of the Companies Act 2006.

Authority is sought for the Company to purchase

up to 10% of its issued ordinary shares (excluding

any treasury shares), less any ordinary shares

repurchased under any authority granted

underResolution 19.

The Company is seeking approval of the terms of

two forms of buyback contract, which are in all

material respects identical to each other apart

from the fee structure, with the two forms of

contract reflecting a brokerage commission fee

structure and a discount to volume weighted

average price fee structure respectively:

•

under the brokerage commission structure,

the fees payable to the programme bank for

the engagement take the form of a brokerage

commission, based on the number of shares

repurchased by the programme bank. The

level of brokerage commission will be

determined at the time the buyback

contractis executed; and

•

under the volume weighted average price fee

structure, the fees payable to the programme

bank for the engagement will be based upon

the pricing achieved by the programme bank

for such repurchases, as compared to an

agreed discount to the volume weighted

average price of the ordinary shares. The

discount to the volume weighted average

price will be determined at the time the

buyback contract is executed.

In addition, details such as the term of the

buyback contract and the maximum number

ofordinary shares to be purchased pursuant

toabuyback contract during such term will

alsobedetermined at the time of execution

ofabuyback contract.

The minimum price, exclusive of expenses, which

may be paid for an ordinary share pursuant to a

buyback contract is €0.07. The maximum price,

exclusive of expenses, which may be paid for an

ordinary share pursuant to a buyback contract is

the higher of: (i) an amount equal to 5% above

the average market value for an ordinary share

for the five business days immediately preceding

the date of the purchase; and (ii) the higher of

the price of the last independent trade and the

highest current independent bid in relation to

ordinary shares on the trading venues where

thepurchase is carried out.

Each buyback contract also annexes a form

ofproposal, which would be the means by

whichthe programme banks would respond

toinvitations to bid for a particular buyback

tranche from time to time during the term of

theauthorisation sought under Resolution 20.

The buyback contracts are proposed to be

entered into with any of Citigroup Global

Markets Limited, BNP Paribas or any of its

affiliates, Goldman Sachs International, Morgan

Stanley & Co. International plc, Merrill Lynch

International, Natixis and UBS AG London

Branch. However, due to the settlement

arrangements for shares traded on Euronext

Amsterdam, CBOE Europe DXE and Turquoise

Europe, the member who would hold any shares

to be purchased under the buyback contracts

would in each case be either Euroclear

Nederland or Euroclear Bank.

Copies of the buyback contracts will be made

available for shareholders to inspect at the

Company’s registered office at Shell Centre,

London, SE1 7NA during normal business hours

on any weekday (public holidays excluded, and

as allowed by law) from the publication of this

Notice until the conclusion of the 2024 AGM.

Copies of the buyback contracts will also be

available for inspection at the AGM.

Under the Companies Act 2006, the Company

must seek authorisation for share repurchase

contracts and counterparties at least every

fiveyears. However, the authority sought under

Resolution 19 will expire at the earlier of the close

of business on August 20, 2025, and the end of

the AGM of the Company to be held in 2025.

Note to resolution 21

Authority for certain donations

andexpenditure

The Company is seeking authority under this

resolution to allow the Company and any of its

subsidiaries to make political donations or incur

political expenditure up to a limit of £100,000

for each category of donation or expenditure

asset out in the resolution.

The Directors are seeking such authority for a

period ending on the date of the Company’s

AGM in 2025 or, if earlier, close of business

onAugust 20, 2025.

The Company has no intention of

changing its current practice of

not making political donations

to political parties, independent

election candidates and/or political

organisations, or incurring political

expenditure within the ordinary

meaning of those words and will

not do so without the specific

endorsement of shareholders.

However, the definitions used in the Companies

Act 2006 are very wide and open to

interpretation. As such, it is possible that normal

business activities which might not be thought to

be political donations or expenditure in the usual

sense could be caught. This could include

donations and contributions to, for example,

bodies concerned with policy review and law

Explanatory notes on resolutions continued

13Shell Notice of Annual General Meeting 2024

reform, with the representation of the

businesscommunity or sections of it or with

therepresentation of other communities or

special interest groups, which it may be in

theCompany’s interest to support.

In order to allow such activities to continue and

avoid inadvertently contravening the Companies

Act 2006, the Company considers that the

authority sought under this resolution to make

political donations and incur political expenditure

is advisable, in common with many other

listedcompanies.

The UK Companies Act 2006 requires that the

authority should specify the maximum amount

that the Company and its subsidiaries can

spendon each category of political donations

orexpenditure during the period. To ensure

sufficient flexibility, the resolution provides

thatthis maximum amount is £100,000 for the

Company and its subsidiaries, in respect of each

category, over the whole period of the authority

until its expiration in 2025.

Note to resolution 22

Shell’s Energy Transition Strategy

2024 resolution

Resolution 22 is an advisory vote seeking

approval of Shell’s energy transition update as

disclosed in Shell’s Annual Report and Accounts

for the year-ended December 31, 2023

(published on shell.com/annualreport) AND

Shell’s Energy Transition Strategy 2024

(published on the Shell website shell.com/agm

and incorporated in this Notice by reference).

TheBoard is fully aligned with this strategy and

believes it will deliver value for our shareholders,

our customers and wider society. Voting in favour

of this resolution shows support for both the

Company and how it intends to progress its

energy transition strategy.

The Shell Energy Transition Strategy 2024 is also

available for inspection. Please see page 24

forfurther information.

Note to resolution 23

Shareholder resolution

Resolution 23 is a special resolution and has

been requisitioned by a group of shareholders.

The resolution should be read with its

corresponding supporting statement given on

page 8, andtheDirectors’ response given on

pages9to 10.

Your Directors consider that Resolution 23 is

notin the best interests of the Company and

itsshareholders as a whole and recommend

shareholders vote against Resolution 23.

Explanatory notes on resolutions continued

Your Directors consider that Resolutions 1 to 22 are in the best interests of the Company and its

shareholders as a whole. The Directors therefore unanimously recommend that you vote in favour

ofResolutions 1 to 22. However, they consider that Resolution 23 is not in the best interests of the

Company and its shareholders as a whole and unanimously recommend that you vote against

Resolution 23 for the reasons set out on pages 9 to 10.

14 Shell Notice of Annual General Meeting 2024

Directors’ biographies

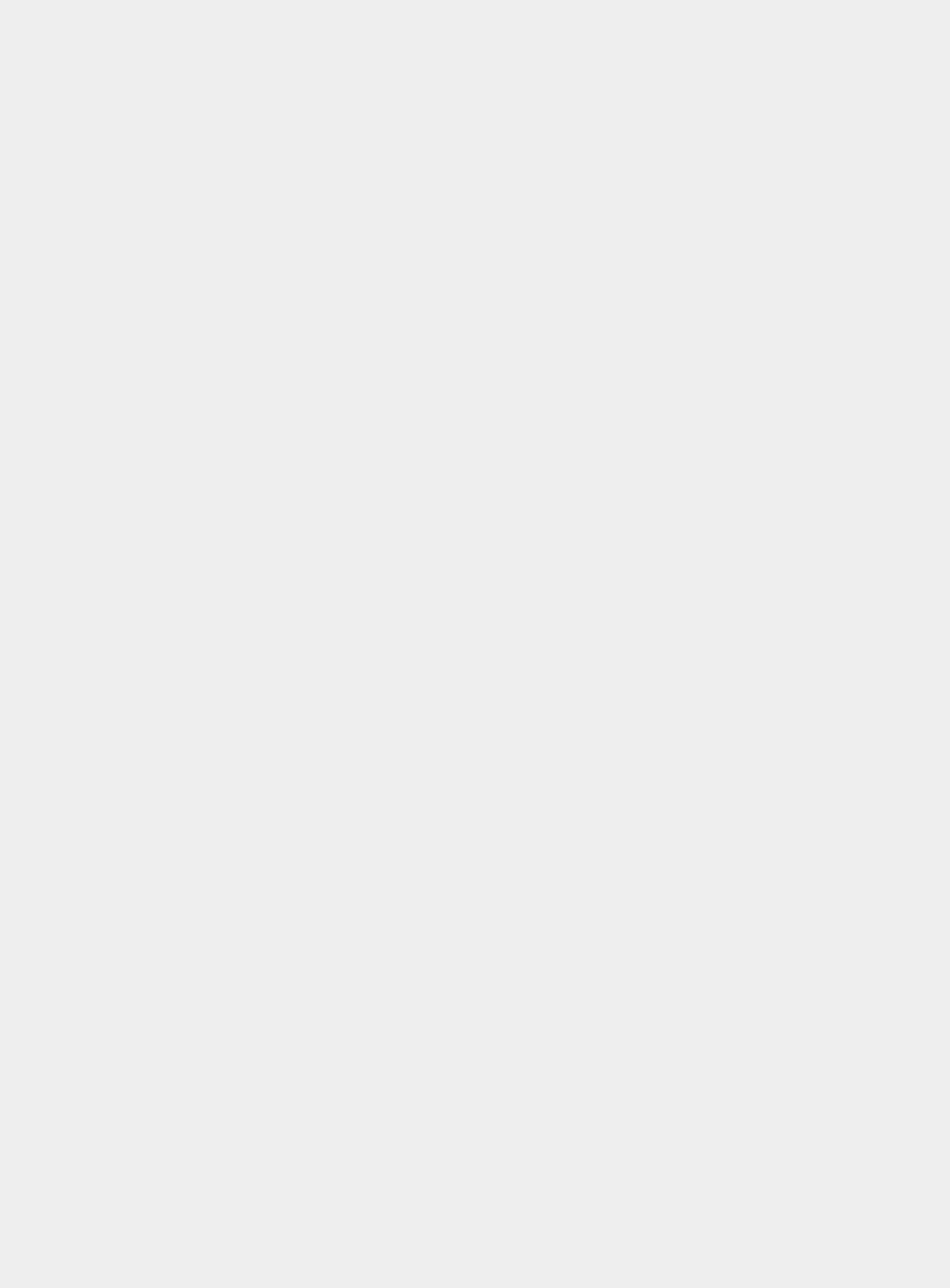

Career

Prior to joining Shell, Sir Andrew Mackenzie was CEO of BHP from 2013 to 2019 after joining BHP in

2008. As BHP CEO, he simplified and strengthened the business, and made it the first miner to pledge

totackle emissions caused when customers use its products.

From 2004 to 2007 at Rio Tinto, Sir Andrew was Head of Industrial Minerals, then Head of Industrial

Minerals and Diamonds. Prior to this, Sir Andrew spent 22 years with BP, joining in 1982 in research and

development, followed by international operations and technology roles across most business streams

and functions – principally in exploration and production, and petrochemicals, including as Chief

Reservoir Engineer and Chief Technology Officer. Sir Andrew was also Vice President for Chemicals

intheAmericas, then Olefins and Polymers globally.

From 2005 to 2013, Sir Andrew served as a Non-executive Director of Centrica. He has also served on

many not-for-profit boards, including public policy think tanks in the UK and Australia. He was knighted

in2020 for services to business, science, technology and UK-Australia relations.

Relevant skills and experience

Sir Andrew has led international FTSE 100 businesses, and has more than 30 years’ experience in

themining and energy industries. Following early academic distinction, Sir Andrew made important

contributions to geochemistry, including groundbreaking methods for oil exploration and recovery.

Hewas recognised as “one of the world’s most influential earth scientists” and made a Fellow of the

RoyalSociety in 2014.

Sir Andrew has applied his deep understanding of the energy business and geopolitical outlook to

createpublic-private partnerships and advise governments around the world. He has consistently

pursuedsustainable action on climate change in the interests of access to affordable energy and global

development. His expertise is helping Shell navigate the energy transition. Sir Andrew also champions

gender balance, the rights of Indigenous Peoples, and the power of large companies to make a positive

contribution to society – all of which align closely with Shell’s purpose, strategy and values.

Sir Andrew Mackenzie

Chair

Tenure

Chair – Two years and nine months

(appointed May 18, 2021)

On Board – Three years and five months

(appointed October 1, 2020)

Board committee membership

Chair of the Nomination and Succession Committee

Outside commitments on listed and large

private companies

Chair of UK Research and Innovation (UKRI)

Age

67

Nationality

British

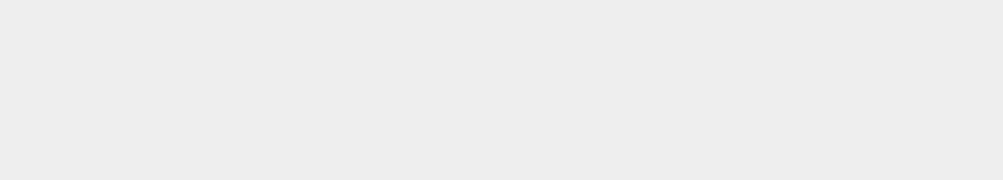

Career

Dick Boer was President and CEO of Ahold Delhaize from 2016 to 2018. Prior to the merger between

Ahold and Delhaize, he served as President and CEO of Royal Ahold from 2011 to 2016. From 2006 to

2011 he was a member of the Executive Board of Ahold and served as Chief Operating Officer of Ahold

Europe. Dick joined Ahold in 1998 as CEO of Ahold Czech Republic and was appointed President and

CEO of Albert Heijn in 2000. In 2003, he also became President and CEO of Ahold’s Dutch businesses.

Before joining Ahold, Dick spent more than 17 years in various retail positions, for SHV Holdings N.V. in

theNetherlands and abroad, and for Unigro N.V.

Relevant skills and experience

Dick has a deep understanding of brands and consumers, and extensive knowledge of the US and

European markets, from his time leading one of the world’s largest food retail groups. He has considerable

experience at the forefront of retailing and customer service, which extended in more recent years to

e-commerce and the digital arena. This experience is most timely as Shell focuses on the growth of our

marketing activities and increasing consumer choices in energy products.

Dick brings sound business judgement and a proven track record in strategic delivery to Shell, evidenced

by the combination of Ahold and Delhaize. He is also passionate about sustainability and is well informed

on the importance of the various stakeholder interests in this area.

Dick Boer

Deputy Chair and Senior Independent Director

Tenure

Three years and nine months

(appointed May 20, 2020)

Dick was appointed Deputy Chair and Senior

Independent Director on May 23, 2023.

Board committee membership

Member of the Audit and Risk Committee, member

of the Nomination and Succession Committee,

andamember of the Remuneration Committee